Asked by Tomas Calderaro on Jul 01, 2024

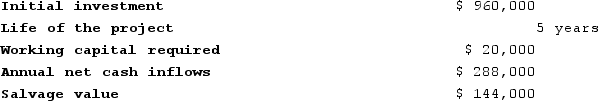

Tiff Corporation has provided the following data concerning a proposed investment project (Ignore income taxes.):

The company uses a discount rate of 16%. The working capital would be released at the end of the project.Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.Required:Compute the net present value of the project.

The company uses a discount rate of 16%. The working capital would be released at the end of the project.Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.Required:Compute the net present value of the project.

Discount Rate

A rate used to determine the present value of future cash flows; it's often used in discounted cash flow analysis to account for the time value of money.

Net Present Value

The variance between cash inflows and outflows' present value over time, utilized to evaluate an investment's profitability.

Working Capital

The gap between a firm's present assets and liabilities, showing how liquid it is in the short run.

- Absorb the fundamentals of Net Present Value (NPV) and its relevance in scrutinizing potential investment ventures.

- Assess the cash transactions associated with an investment, taking into account salvage values, working capital adjustments, and operational earnings.

- Administer discount rates on cash flows to derive the present value in capital budgeting procedures.

Learning Objectives

- Absorb the fundamentals of Net Present Value (NPV) and its relevance in scrutinizing potential investment ventures.

- Assess the cash transactions associated with an investment, taking into account salvage values, working capital adjustments, and operational earnings.

- Administer discount rates on cash flows to derive the present value in capital budgeting procedures.