Asked by Laura-Leigh Holley on Jun 23, 2024

Verified

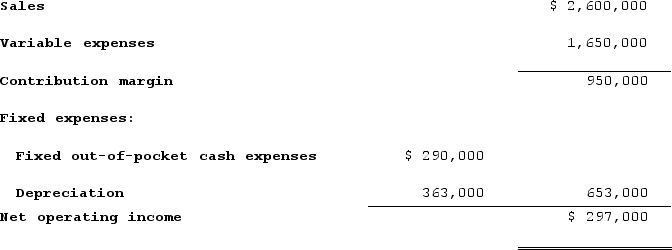

Ursus, Incorporated, is considering a project that would have a eight-year life and would require a $2,904,000 investment in equipment. At the end of eight years, the project would terminate and the equipment would have no salvage value. The project would provide net operating income each year as follows (Ignore income taxes.):

Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.All of the above items, except for depreciation, represent cash flows. The company's required rate of return is 11%.Required:a. Compute the project's net present value. (Round your intermediate calculations and final answer to the nearest whole dollar amount.)

Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.All of the above items, except for depreciation, represent cash flows. The company's required rate of return is 11%.Required:a. Compute the project's net present value. (Round your intermediate calculations and final answer to the nearest whole dollar amount.)

b. Compute the project's internal rate of return. (Round your final answer to the nearest whole percent.)

c. Compute the project's payback period. (Round your answer to 2 decimal place.)

d. Compute the project's simple rate of return. (Round your final answer to the nearest whole percent.)

Required Rate of Return

The minimum return an investor expects to achieve by investing in a particular asset, considering its risk level.

Net Present Value

A financial metric that estimates the profitability of an investment or project by calculating the difference between the present value of cash inflows and the present value of cash outflows over a period of time.

Internal Rate of Return

This is the discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero.

- Capture the significance of Net Present Value (NPV) and its application in the critique of investment strategies.

- Execute discount rates with cash flows to assess the present value in the realm of capital budgeting.

- Understand and calculate the payback period for an investment.

Verified Answer

![a. Because depreciation is the only noncash item on the income statement, the annual net cash flow can be computed by adding back depreciation to net operating income b. The formula for computing the factor of the internal rate of return (IRR) is: Factor of the IRR = Investment required ÷ Annual net cash inflow = ${{[v(2)]:#,###}} ÷ ${{[v(11)]:#,###}} = {{[v(17)]:#,###.00}} This factor is closest to the present value of an annuity over {{[v(22)]:#,###}} years at {{[v(18)]:#,###}}%. Therefore, to the nearest whole percent, the internal rate of return is {{[v(18)]:#,###}}%.c. The formula for the payback period is: Investment required ÷ Annual net cash inflow = Payback period ${{[v(2)]:#,###}} ÷ ${{[v(11)]:#,###}} per year = {{[v(19)]:#,###.00}} yearsd. The formula for the simple rate of return is: Simple rate of return = Net operating income ÷ Initial investment = ${{[v(9)]:#,###}} ÷ ${{[v(2)]:#,###}} = {{[v(20)]:#,###}}%](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_62b9_7a88_bf83_cf26947b12f0_TB8314_00.jpg)

![a. Because depreciation is the only noncash item on the income statement, the annual net cash flow can be computed by adding back depreciation to net operating income b. The formula for computing the factor of the internal rate of return (IRR) is: Factor of the IRR = Investment required ÷ Annual net cash inflow = ${{[v(2)]:#,###}} ÷ ${{[v(11)]:#,###}} = {{[v(17)]:#,###.00}} This factor is closest to the present value of an annuity over {{[v(22)]:#,###}} years at {{[v(18)]:#,###}}%. Therefore, to the nearest whole percent, the internal rate of return is {{[v(18)]:#,###}}%.c. The formula for the payback period is: Investment required ÷ Annual net cash inflow = Payback period ${{[v(2)]:#,###}} ÷ ${{[v(11)]:#,###}} per year = {{[v(19)]:#,###.00}} yearsd. The formula for the simple rate of return is: Simple rate of return = Net operating income ÷ Initial investment = ${{[v(9)]:#,###}} ÷ ${{[v(2)]:#,###}} = {{[v(20)]:#,###}}%](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_62b9_7a89_bf83_2b81eca3ef45_TB8314_00.jpg) b. The formula for computing the factor of the internal rate of return (IRR) is:

b. The formula for computing the factor of the internal rate of return (IRR) is:Factor of the IRR = Investment required ÷ Annual net cash inflow

= ${{[v(2)]:#,###}} ÷ ${{[v(11)]:#,###}} = {{[v(17)]:#,###.00}}

This factor is closest to the present value of an annuity over {{[v(22)]:#,###}} years at {{[v(18)]:#,###}}%. Therefore, to the nearest whole percent, the internal rate of return is {{[v(18)]:#,###}}%.c. The formula for the payback period is:

Investment required ÷ Annual net cash inflow = Payback period

${{[v(2)]:#,###}} ÷ ${{[v(11)]:#,###}} per year = {{[v(19)]:#,###.00}} yearsd. The formula for the simple rate of return is:

Simple rate of return = Net operating income ÷ Initial investment

= ${{[v(9)]:#,###}} ÷ ${{[v(2)]:#,###}} = {{[v(20)]:#,###}}%

Learning Objectives

- Capture the significance of Net Present Value (NPV) and its application in the critique of investment strategies.

- Execute discount rates with cash flows to assess the present value in the realm of capital budgeting.

- Understand and calculate the payback period for an investment.

Related questions

Houze Corporation Has Provided the Following Information Concerning a Capital ...

Tiff Corporation Has Provided the Following Data Concerning a Proposed ...

The Management of Truelove Corporation Is Considering a Project That ...

Cardinal Pharmacy Has Purchased a Small Auto for Delivery of ...

Bill Anders Is Considering Investing in a Franchise in a ...