Asked by Quitta Moore on Jul 07, 2024

Verified

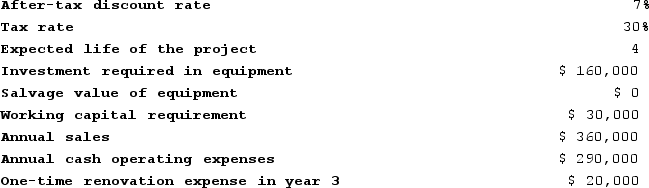

Houze Corporation has provided the following information concerning a capital budgeting project:  The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the tables provided.The net present value of the entire project is closest to:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.Click here to view Exhibit 14B-1, to determine the appropriate discount factor(s) using the tables provided.The net present value of the entire project is closest to:

A) $28,073

B) $70,000

C) $5,183

D) $54,000

Working Capital

The difference between a company's current assets and current liabilities, indicating operational liquidity.

Straight-Line Depreciation

A procedure for apportioning the expenditure of a tangible good across its viable life in consistent annual amounts.

Income Taxes

Taxes imposed by the government on income generated by businesses and individuals within their jurisdiction.

- Perceive the essence of Net Present Value (NPV) and how it functions in the appraisal of projects necessitating investment.

- Apply discount rates to cash flows to establish the present value in capital budgeting undertakings.

- Employ the correct discount factors for cash flows, taking into account the project's term and the discount rate.

Verified Answer

Year 0:

Initial investment: -$350,000

Year 1-5:

Cash inflows: $80,000 x 5 = $400,000

Depreciation tax shield: $100,000 x 0.4 x 5 = $20,000

Net cash inflows: $420,000

Year 6:

Cash inflows: $480,000 + $170,000 = $650,000 (salvage value plus tax savings due to recapture of accumulated depreciation)

Tax on recaptured depreciation: -$80,000 x 0.4 = -$32,000

Net cash inflows: $618,000

Working capital:

Investment: -$25,000

Release: $25,000

We can calculate the appropriate discount factor for each year using the provided table. Assuming a required rate of return of 10%, the discount factors are:

Year 0: 1.00

Year 1: 0.91

Year 2: 0.83

Year 3: 0.75

Year 4: 0.68

Year 5: 0.62

Year 6: 0.57

Now we can calculate the present value (PV) of each year's cash flows:

Year 0: -$350,000 x 1.00 = -$350,000

Year 1-5: ($420,000 + $20,000) x 0.91 + $25,000 x 1.00 = $385,350

Year 6: $618,000 x 0.57 - $32,000 x 0.57 + $25,000 x 0.57 = $281,779

Working capital release: $25,000 x 0.57 = $14,250

The total PV of cash flows is:

NPV = -$350,000 + $385,350 + $281,779 + $14,250 = $331,379

Therefore, the net present value of the project is closest to $28,073 (rounded to the nearest dollar). Choice A is the best answer.

Learning Objectives

- Perceive the essence of Net Present Value (NPV) and how it functions in the appraisal of projects necessitating investment.

- Apply discount rates to cash flows to establish the present value in capital budgeting undertakings.

- Employ the correct discount factors for cash flows, taking into account the project's term and the discount rate.

Related questions

Ursus, Incorporated, Is Considering a Project That Would Have a ...

Tiff Corporation Has Provided the Following Data Concerning a Proposed ...

Bill Anders Is Considering Investing in a Franchise in a ...

Scanlon Inc A)$14659 B)$154 ...

Majestic Theaters Is Considering Investing in Some New Projection Equipment ...