Asked by Shubrenia Scott on Jul 07, 2024

Verified

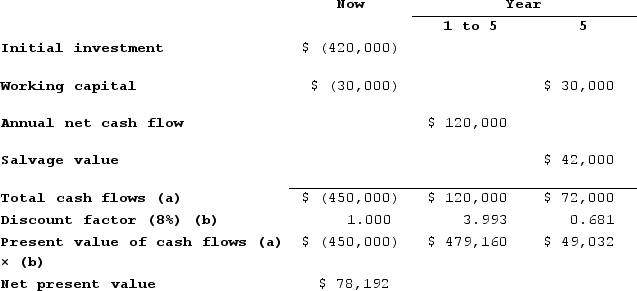

Bill Anders is considering investing in a franchise in a fast-food chain. He would have to purchase equipment costing $420,000 to equip the outlet and invest an additional $30,000 for inventories and other working capital needs. Other outlets in the fast-food chain have an annual net cash inflow of about $120,000. Mr. Anders would close the outlet in 5 years. He estimates that the equipment could be sold at that time for about 10% of its original cost and the working capital would be released for use elsewhere. Mr. Anders' required rate of return is 8%. (Ignore income taxes.)Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.Required:What is the investment's net present value? Is this an acceptable investment?

Required Rate of Return

The minimum return an investor expects to receive on an investment to compensate for its risk.

Net Present Value

A method used in capital budgeting to evaluate the profitability of an investment by calculating the difference between the present value of cash inflows and outflows.

Working Capital

The distinction between a corporation's short-term assets and liabilities, showing the available capital for operational purposes.

- Apprehend the theory of Net Present Value (NPV) and its implementation in evaluating the viability of investment proposals.

- Formulate investment strategies by evaluating net present value, payback period, and simple rate of return metrics.

Verified Answer

Yes, the outlet is an acceptable investment because its net present value is positive.

Yes, the outlet is an acceptable investment because its net present value is positive.

Learning Objectives

- Apprehend the theory of Net Present Value (NPV) and its implementation in evaluating the viability of investment proposals.

- Formulate investment strategies by evaluating net present value, payback period, and simple rate of return metrics.

Related questions

Houze Corporation Has Provided the Following Information Concerning a Capital ...

Ursus, Incorporated, Is Considering a Project That Would Have a ...

Tiff Corporation Has Provided the Following Data Concerning a Proposed ...

Scanlon Inc A)$14659 B)$154 ...

Majestic Theaters Is Considering Investing in Some New Projection Equipment ...