Asked by Nelli Vartanian on Apr 29, 2024

Verified

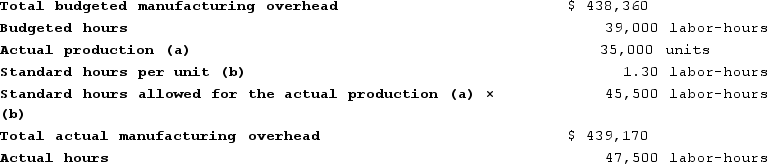

Stallbaumer Incorporated makes a single product--an electrical motor used in many long-haul trucks. The company has a standard cost system in which it applies overhead to this product based on the standard labor-hours allowed for the actual output of the period. Data concerning the most recent year appear below:

Required:

Required:

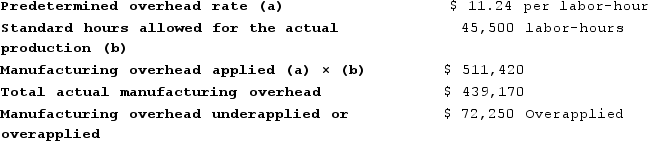

Determine whether overhead was underapplied or overapplied for the year and by how much.

Overapplied

A situation in cost accounting where the allocated manufacturing overhead for a period exceeds the actual manufacturing overhead costs incurred.

Underapplied

The situation in which the allocated manufacturing overhead costs are less than the actual overhead costs incurred, leading to a shortfall.

Standard Labor-Hours

The predetermined amount of time expected to be spent on a specific task or production process, used for planning and efficiency analysis.

- Assess the repercussions of underapplied or overapplied overhead on a company's financial situation.

Verified Answer

Learning Objectives

- Assess the repercussions of underapplied or overapplied overhead on a company's financial situation.

Related questions

Emanuele Incorporated Makes a Single Product--A Critical Part Used in ...

Fenderson Incorporated Makes a Single Product--A Cooling Coil Used in ...

Pickell Incorporated Makes a Single Product--A Cooling Coil Used in ...

Khat Incorporated Makes a Single Product--A Cooling Coil Used in ...

Gaters Incorporated Makes a Single Product--An Electrical Motor Used in ...