Asked by vitor zucco on May 17, 2024

Verified

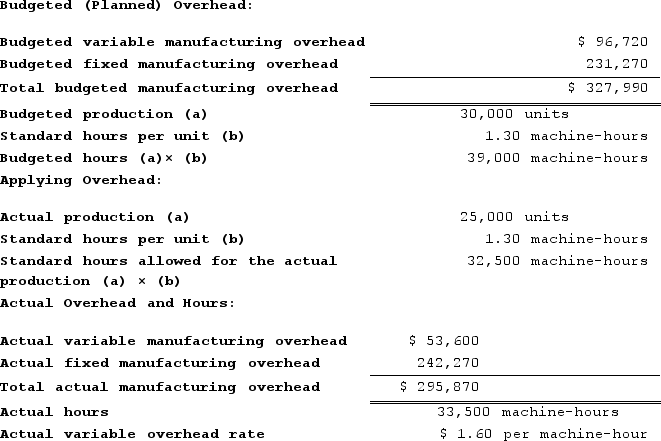

Pickell Incorporated makes a single product--a cooling coil used in commercial refrigerators. The company has a standard cost system in which it applies overhead to this product based on the standard machine-hours allowed for the actual output of the period. Data concerning the most recent year appear below:

Required:

Required:

a. Determine the variable overhead rate variance for the year.

b. Determine the variable overhead efficiency variance for the year.

c. Determine the fixed overhead budget variance for the year.

d. Determine the fixed overhead volume variance for the year.

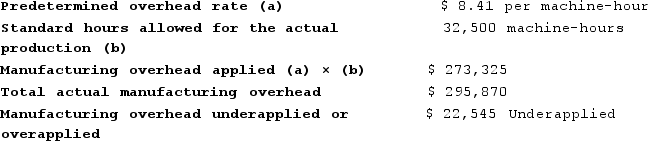

e. Determine whether overhead was underapplied or overapplied for the year and by how much.

Variable Overhead Rate

A rate used to allocate variable overhead costs to products or services, which fluctuates with changes in production or activity level.

Overhead Efficiency

Measures how well a company or organization utilizes its overhead expenses to produce goods or provide services.

Fixed Overhead Budget

A plan that outlines the expected fixed costs of operating a business or manufacturing a product, which do not change with production volume or sales levels.

- Evaluate a range of variances tied to manufacturing overhead, covering budget, volume, rate, and efficiency variances.

- Examine the effect of underapplied or overapplied overhead on financial results.

Verified Answer

= $2.48 per machine-hour

Variable overhead rate variance = (Actual hours × Actual rate) − (Actual hours × Standard rate)

= ($53,600) − (33,500 machine-hours × $2.48 per machine-hour)

= ($53,600) − ($83,080)

= $29,480 Favorable

b. Labor efficiency variance = (Actual hours − Standard hours) × Standard rate

= (33,500 machine-hours − 32,500 machine-hours) × $2.48 per machine-hour

= (1,000 machine-hours) × $2.48 per machine-hour

= $2,480 Unfavorable

c. Budget variance = Actual fixed overhead − Budgeted fixed overhead

= $242,270 − $231,270 = $11,000 Unfavorable

d. Fixed component of the predetermined overhead rate = $231,270/39,000 machine-hours

= $5.93 per machine-hour

Volume variance = Budgeted fixed overhead − Fixed overhead applied to work in process

= $231,270 − ($5.93 per machine-hour × 32,500 machine-hours)

= $231,270 − ($192,725)

= $38,545 Unfavorable

e. Predetermined overhead rate = $327,990/39,000 machine-hours = $8.41 per machine-hour

Learning Objectives

- Evaluate a range of variances tied to manufacturing overhead, covering budget, volume, rate, and efficiency variances.

- Examine the effect of underapplied or overapplied overhead on financial results.

Related questions

Gaters Incorporated Makes a Single Product--An Electrical Motor Used in ...

You Have Just Been Hired as the Controller of the ...

Modine Corporation Has Provided the Following Data for September ...

Berk Incorporated Makes a Single Product--A Critical Part Used in ...

Emanuele Incorporated Makes a Single Product--A Critical Part Used in ...