Asked by Gildardo Ramos on May 18, 2024

Verified

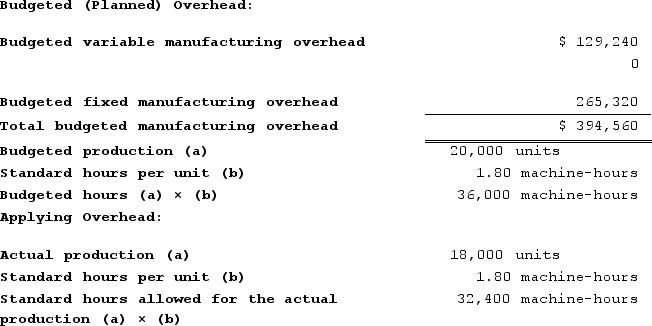

Fenderson Incorporated makes a single product--a cooling coil used in commercial refrigerators. The company has a standard cost system in which it applies overhead to this product based on the standard machine-hours allowed for the actual output of the period. Data concerning the most recent year appear below:

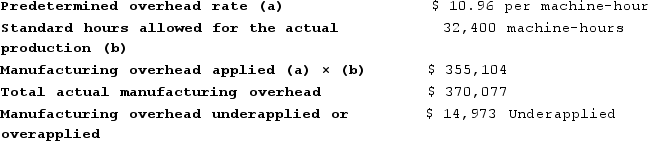

The company incurred a total of $370,077 in manufacturing overhead cost during the year.

The company incurred a total of $370,077 in manufacturing overhead cost during the year.

Required:

a. Compute the variable component of the company's predetermined overhead rate.

b. Compute the fixed component of the company's predetermined overhead rate.

c. Compute the company's predetermined overhead rate.

d. Determine whether overhead was underapplied or overapplied for the year and by how much.

Predetermined Overhead Rate

An estimated rate used to allocate manufacturing overhead costs to products or job orders, based on a chosen activity base such as direct labor hours.

Variable Component

A part of a cost or expense that varies directly with the level of output or activity.

Fixed Component

A cost that remains unchanged in total regardless of changes in the level of activity or output over a certain period.

- Analyze the influence of underapplied or overapplied overhead on the financial health of a company.

- Investigate the constituents of a predetermined overhead rate and the methodology of its calculation.

Verified Answer

b. Fixed component of the predetermined overhead rate = $265,320/36,000 machine-hours = $7.37 per machine-hour

c. Predetermined overhead rate = $394,560/36,000 machine-hours = $10.96 per machine-hour

d.

Learning Objectives

- Analyze the influence of underapplied or overapplied overhead on the financial health of a company.

- Investigate the constituents of a predetermined overhead rate and the methodology of its calculation.

Related questions

Gaters Incorporated Makes a Single Product--An Electrical Motor Used in ...

Pickell Incorporated Makes a Single Product--A Cooling Coil Used in ...

Hykes Corporation's Manufacturing Overhead Includes $5 ...

Held Incorporated Makes a Single Product--An Electrical Motor Used in ...

Emanuele Incorporated Makes a Single Product--A Critical Part Used in ...