Asked by Rebekah Hilton on Jun 16, 2024

Verified

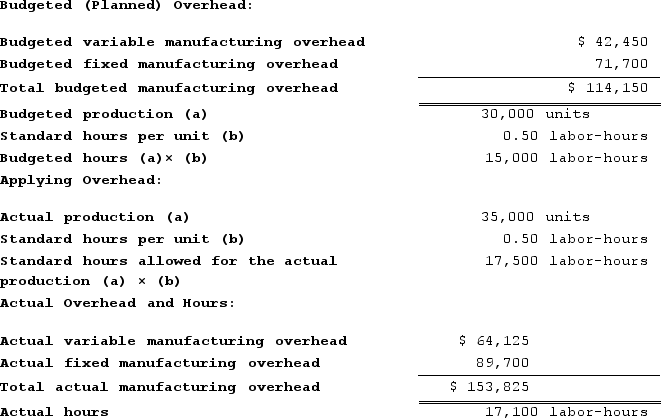

Khat Incorporated makes a single product--a cooling coil used in commercial refrigerators. The company has a standard cost system in which it applies overhead to this product based on the standard labor-hours allowed for the actual output of the period. Data concerning the most recent year appear below:

Required:

Required:

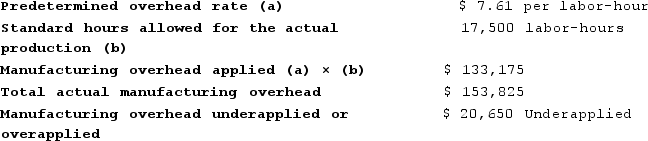

Determine whether overhead was underapplied or overapplied for the year and by how much.

Overapplied

In cost accounting, it refers to a situation where the allocated overhead for a period is more than the actual overhead incurred.

Underapplied

A situation where the assigned manufacturing overhead expenses fall short of the real overhead costs that have been spent.

Standard Labor-Hours

The predetermined amount of labor-hours expected to be required to produce a unit of product or perform a task.

- Investigate the consequences of underapplied or overapplied overhead on financial performance.

Verified Answer

Learning Objectives

- Investigate the consequences of underapplied or overapplied overhead on financial performance.

Related questions

Emanuele Incorporated Makes a Single Product--A Critical Part Used in ...

Stallbaumer Incorporated Makes a Single Product--An Electrical Motor Used in ...

Gaters Incorporated Makes a Single Product--An Electrical Motor Used in ...

Hargett Incorporated Makes a Single Product--An Electrical Motor Used in ...

Pickell Incorporated Makes a Single Product--A Cooling Coil Used in ...