Asked by Malaisha Easter on Apr 26, 2024

Verified

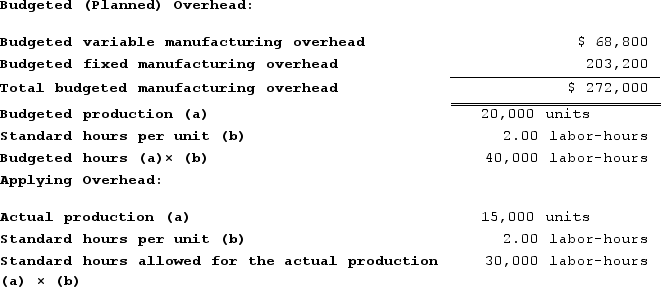

Gaters Incorporated makes a single product--an electrical motor used in many long-haul trucks. The company has a standard cost system in which it applies overhead to this product based on the standard labor-hours allowed for the actual output of the period. Data concerning the most recent year appear below:

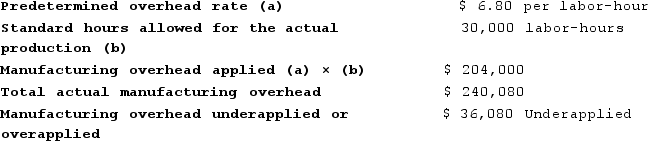

The company incurred a total of $240,080 in manufacturing overhead cost during the year.

The company incurred a total of $240,080 in manufacturing overhead cost during the year.

Required:

Determine whether overhead was underapplied or overapplied for the year and by how much.

Overapplied

A scenario in which the overhead attributed to products or services surpasses the real overhead expenses.

Manufacturing Overhead Cost

Expenses related to the manufacturing process that are not directly tied to the production of goods, such as utilities and rent for the manufacturing facilities.

Actual Output

refers to the actual quantity of goods or services produced by a business within a given period.

- Explore the implications of underapplied or overapplied overhead on financial success.

Verified Answer

Learning Objectives

- Explore the implications of underapplied or overapplied overhead on financial success.

Related questions

Fenderson Incorporated Makes a Single Product--A Cooling Coil Used in ...

Khat Incorporated Makes a Single Product--A Cooling Coil Used in ...

Pickell Incorporated Makes a Single Product--A Cooling Coil Used in ...

Held Incorporated Makes a Single Product--An Electrical Motor Used in ...

Emanuele Incorporated Makes a Single Product--A Critical Part Used in ...