Asked by Samantha Beveridge on Apr 25, 2024

Verified

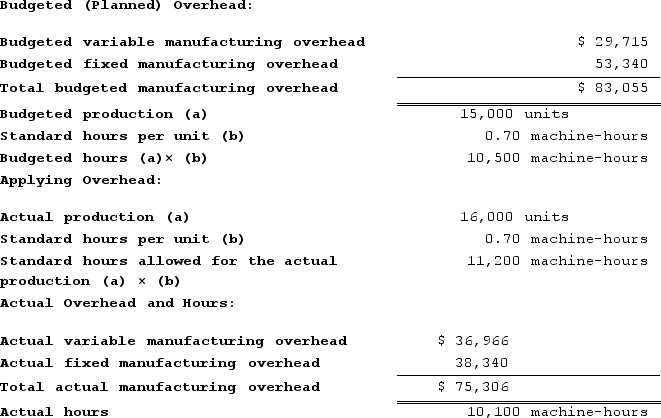

Emanuele Incorporated makes a single product--a critical part used in commercial airline seats. The company has a standard cost system in which it applies overhead to this product based on the standard machine-hours allowed for the actual output of the period. Data concerning the most recent year appear below:

Required:

Required:

a. Compute the variable component of the company's predetermined overhead rate.

b. Compute the fixed component of the company's predetermined overhead rate.

c. Compute the company's predetermined overhead rate.

d. Determine the variable overhead rate variance for the year.

e. Determine the variable overhead efficiency variance for the year.

f. Determine the fixed overhead budget variance for the year.

g. Determine the fixed overhead volume variance for the year.

h. Determine whether overhead was underapplied or overapplied for the year and by how much.

Variable Component

Part of a cost or expense that changes in proportion with the level of activity or volume of output.

Fixed Component

A portion of a cost that does not change with the level of production or sales over the short term.

Overapplied

A scenario in which the overhead costs allocated are higher than the overhead costs that were actually incurred.

- Quantify multiple variances concerning manufacturing overhead, including budget, volume, rate, and efficiency variances.

- Evaluate how underapplied or overapplied overhead affects financial outcomes.

- Examine the elements that make up a predetermined overhead rate and how it is computed.

Verified Answer

= $2.83 per machine-hour

b. Fixed component of the predetermined overhead rate = $53,340/10,500 machine-hours

= $5.08 per machine-hour

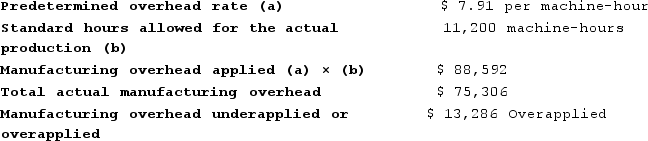

c. Predetermined overhead rate = $83,055/10,500 machine-hours = $7.91 per machine-hour

d. Variable overhead rate variance = (Actual hours × Actual rate) − (Actual hours × Standard rate)

= ($36,966) − (10,100 machine-hours × $2.83 per machine-hour)

= ($36,966) − ($28,583)

= $8,383 Unfavorable

e. Variable overhead efficiency variance = (Actual hours − Standard hours) × Standard rate

= (10,100 machine-hours − 11,200 machine-hours) × $2.83 per machine-hour

= (−1,100 machine-hours) × $2.83 per machine-hour

= $3,113 Favorable

f. Budget variance = Actual fixed overhead − Budgeted fixed overhead

= $38,340 − $53,340 = $15,000 Favorable

g. Volume variance = Budgeted fixed overhead − Fixed overhead applied to work in process

= $53,340 − ($5.08 per machine-hour × 11,200 machine-hours)

= $53,340 − ($56,896)

= $3,556 Favorable

h. Predetermined overhead rate = $83,055/10,500 machine-hours = $7.91 per machine-hour

Learning Objectives

- Quantify multiple variances concerning manufacturing overhead, including budget, volume, rate, and efficiency variances.

- Evaluate how underapplied or overapplied overhead affects financial outcomes.

- Examine the elements that make up a predetermined overhead rate and how it is computed.

Related questions

Benoit Corporation's Manufacturing Overhead Includes $14 ...

Khat Incorporated Makes a Single Product--A Cooling Coil Used in ...

Canel Incorporated Makes a Single Product--An Electrical Motor Used in ...

Pickell Incorporated Makes a Single Product--A Cooling Coil Used in ...

Modine Corporation Has Provided the Following Data for September ...