Asked by Salvi Sharma on Jun 10, 2024

Verified

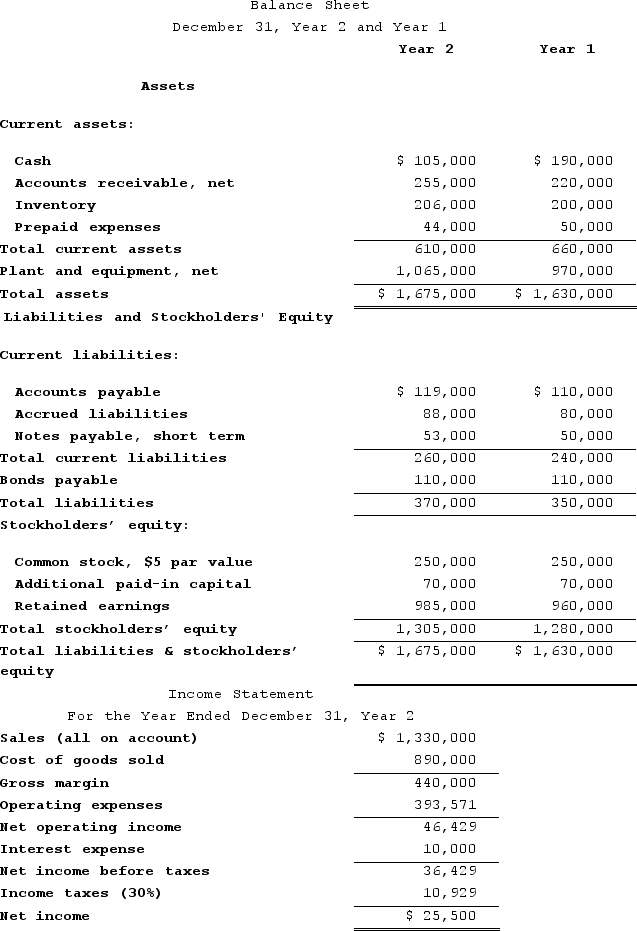

Mahoe Corporation has provided the following financial data:  Dividends on common stock during Year 2 totaled $500. The market price of common stock at the end of Year 2 was $8.06 per share.The company's equity multiplier at the end of Year 2 is closest to:

Dividends on common stock during Year 2 totaled $500. The market price of common stock at the end of Year 2 was $8.06 per share.The company's equity multiplier at the end of Year 2 is closest to:

A) 0.28

B) 1.28

C) 3.53

D) 0.78

Equity Multiplier

A financial ratio that measures the amount of a company's assets that are financed by its shareholders' equity.

Common Stock

A type of equity security that represents ownership in a corporation, entitling holders to a share of the corporation's profits and assets.

Market Price

The ongoing rate for transactions involving the purchase or sale of assets or services.

- Explore the financial leverage by analyzing the equity multiplier, debt-to-equity ratio, and times interest earned ratio to understand the financial constitution and risk of a company.

Verified Answer

Total number of outstanding common shares = Dividends on common stock / Dividend per share

= $500 / ($8.06 − $0) = 61.99

Total market value of common equity = Total number of outstanding common shares × Market price per share

= 61.99 × $8.06 = $501.51

Total assets = Total market value of common equity / Common equity ratio

We do not have the common equity ratio to calculate total assets, but we can use the equity multiplier formula:

Equity multiplier = Total assets / Total common equity

Equity multiplier = (Total market value of common equity + Total debt) / Total common equity

The equity multiplier represents how much assets a company has for each dollar of common equity.

Assuming the company has no preferred stock or non-controlling interest, we can rearrange the formula:

Total debt = Equity multiplier × Total common equity − Total market value of common equity

We are given that dividends on common stock totaled $500 during Year 2. This is usually paid out of net income, which is equal to earnings available to common shareholders.

Earnings available to common shareholders = Dividends on common stock / Dividend payout ratio

Assuming a constant dividend payout ratio, we can calculate earnings available to common shareholders.

Earnings available to common shareholders = $500 / Dividend payout ratio

We do not have the dividend payout ratio to calculate earnings available to common shareholders, but we can use the following formula:

Earnings available to common shareholders = Net income − Preferred dividends

Since we are assuming that there is no preferred stock, we can simplify the formula:

Net income = Earnings available to common shareholders

We do not have net income, but we can use the following formula:

Net income = Return on equity × Average common equity

We do not have the return on equity, but we can use the following formula:

Return on equity = Net income / Average common equity

We do not have average common equity, but we can use the following formula:

Average common equity = (Beginning common equity + Ending common equity) / 2

We do not have the beginning common equity, but we can assume that it is equal to the ending common equity from the previous year.

Ending common equity for Year 1 is not given, so we cannot calculate average common equity. Therefore, we cannot calculate net income or earnings available to common shareholders.

Without this information, we cannot calculate the equity multiplier directly. However, we can use the fact that the equity multiplier represents how much assets a company has for each dollar of common equity to eliminate the choices that do not make sense.

Choice A (0.28): This implies that the company has only $0.28 of assets for each dollar of common equity, which is unlikely.

Choice C (3.53): This implies that the company has $3.53 of assets for each dollar of common equity, which is possible but unlikely given the market price of common stock at the end of Year 2.

Choice D (0.78): This implies that the company has only $0.78 of assets for each dollar of common equity, which is unlikely.

Choice B (1.28): This implies that the company has $1.28 of assets for each dollar of common equity, which is reasonable. Therefore, the best choice is B.

Learning Objectives

- Explore the financial leverage by analyzing the equity multiplier, debt-to-equity ratio, and times interest earned ratio to understand the financial constitution and risk of a company.

Related questions

Neiger Corporation Has Provided the Following Financial Data ...

Fraction Corporation Has Provided the Following Financial Data: Required ...

Kisselburg Corporation Has Provided the Following Financial Data ...

Remley Corporation Has Provided the Following Financial Data ...

Sidell Corporation's Most Recent Balance Sheet and Income Statement Appear ...