Asked by Heather Weathers on May 28, 2024

Verified

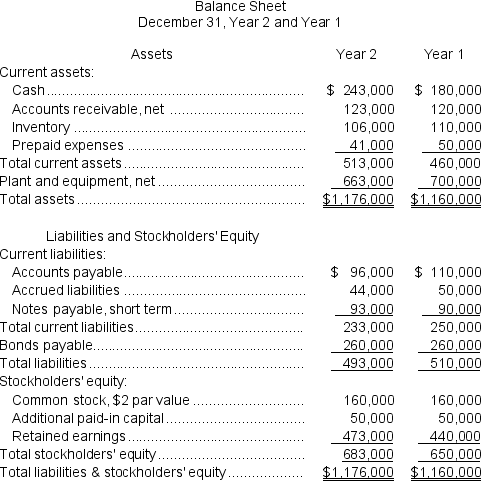

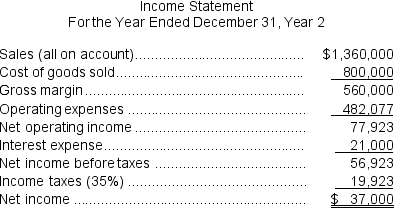

Kisselburg Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $4,000.The market price of common stock at the end of Year 2 was $5.75 per share.

Dividends on common stock during Year 2 totaled $4,000.The market price of common stock at the end of Year 2 was $5.75 per share.

Required:

a.What is the company's working capital at the end of Year 2?

b.What is the company's current ratio at the end of Year 2?

c.What is the company's acid-test (quick)ratio at the end of Year 2?

d.What is the company's accounts receivable turnover for Year 2?

e.What is the company's average collection period for Year 2?

f.What is the company's inventory turnover for Year 2?

g.What is the company's average sale period for Year 2?

h.What is the company's operating cycle for Year 2?

i.What is the company's total asset turnover for Year 2?

j.What is the company's times interest earned ratio for Year 2?

k.What is the company's debt-to-equity ratio at the end of Year 2?

l.What is the company's equity multiplier at the end of Year 2?

m.What is the company's net profit margin percentage for Year 2?

n.What is the company's gross margin percentage for Year 2?

o.What is the company's return on total assets for Year 2?

p.What is the company's return on equity for Year 2?

q.What is the company's earnings per share for Year 2?

r.What is the company's price-earnings ratio for Year 2?

s.What is the company's dividend payout ratio for Year 2?

t.What is the company's dividend yield ratio for Year 2?

u.What is the company's book value per share at the end of Year 2?

Acid-test Ratio

A financial metric that measures a company's ability to pay its current liabilities without relying on the sale of its inventories, calculated by dividing liquid assets by current liabilities.

Debt-to-equity Ratio

A ratio indicating the balance between shareholder equity and debt used in the financial structuring of a company's assets.

Receivable Turnover

A financial metric indicating how quickly a company collects payments owed from its customers, often measured over a year.

- Undertake an analysis of a firm's liquidity by considering working capital, current ratio, and acid-test ratio.

- Determine company efficiency by investigating accounts receivable turnover, inventory turnover, and the operating cycle.

- Delve into and acknowledge the significance of various financial ratios.

Verified Answer

= $513,000 - $233,000 = $280,000

b.Current ratio = Current assets ÷ Current liabilities

= $513,000 ÷ $233,000 = 2.20 (rounded)

c.Acid-test (quick)ratio = Quick assets* ÷ Current liabilities

= $366,000 ÷ $233,000 = 1.57 (rounded)

*Quick assets = Cash + Marketable securities + Current receivables

= $243,000 + $0 + $123,000 = $366,000

d.Accounts receivable turnover = Sales on account ÷ Average accounts receivable*

= $1,360,000 ÷ $121,500 = 11.19 (rounded)

*Average accounts receivable =

($123,000 + $120,000)÷ 2 = $121,500

e.Average collection period = 365 days ÷ Accounts receivable turnover

= 365 days ÷ 11.19 = 32.6 days (rounded)

f.Inventory turnover = Cost of goods sold ÷ Average inventory*

= $800,000 ÷ $108,000 = 7.41 (rounded)

*Average inventory = ($106,000 + $110,000)÷ 2 = $108,000

g.Average sale period = 365 days ÷ Inventory turnover

= 365 days ÷ 7.41 = 49.3 days (rounded)

h.Operating cycle = Average sale period + Average collection period

= 49.3 days + 32.6 days = 81.9 days

i.Total asset turnover = Sales ÷ Average total assets*

= $1,360,000 ÷ $1,168,000 = 1.16 (rounded)

*Average total assets = ($1,176,000 + $1,160,000)÷ 2 = $1,168,000

j.Times interest earned = Earnings before interest expense and income taxes ÷ Interest expense

= $77,923 ÷ $21,000 = 3.71 (rounded)

k.Debt-to-equity ratio = Total liabilities ÷ Stockholders' equity

= $493,000 ÷ $683,000 = 0.72 (rounded)

l.Equity multiplier = Average total assets* ÷ Average stockholders' equity*

= $1,168,000 ÷ $666,500 = 1.75 (rounded)

*Average total assets = ($1,176,000 + $1,160,000)÷ 2 = $1,168,000

**Average stockholders' equity = ($683,000 + $650,000)÷ 2 = $666,500

m.Net profit margin percentage = Net income ÷ Sales

= $37,000 ÷ $1,360,000 = 2.7% (rounded)

n.Gross margin percentage = Gross margin ÷ Sales

= $560,000 ÷ $1,360,000 = 41.2% (rounded)

o.Return on total assets = Adjusted net income* ÷ Average total assets**

= $50,650 ÷ $1,168,000 = 4.34% (rounded)

*Adjusted net income = Net income + [Interest expense × (1 - Tax rate)]

= $37,000 + [$21,000 × (1 - 0.35)] = $50,650

**Average total assets = ($1,176,000 + $1,160,000)÷ 2 = $1,168,000

p.Return on equity = Net income ÷ Average stockholders' equity*

= $37,000 ÷ $666,500 = 5.55% (rounded)

*Average stockholders' equity = ($683,000 + $650,000)÷ 2 = $666,500

q.Earnings per share = Net Income ÷ Average number of common shares outstanding*

= $37,000 ÷ 80,000 shares = $0.46 per share (rounded)

*Number of common shares outstanding = Common stock ÷ Par value

= $160,000 ÷ $2 per share = 80,000 shares

r.Price-earnings ratio = Market price per share ÷ Earnings per share

= $5.75 ÷ $0.46 = 12.50 (rounded)

s.Dividend payout ratio = Dividends per share* ÷ Earnings per share

= $0.05 ÷ $0.46 = 10.9% (rounded)

*Dividends per share = Common dividends ÷ Common shares (see above)

= $4,000 ÷ 80,000 shares = $0.05 per share (rounded)

t.Dividend yield ratio = Dividends per share* ÷ Market price per share

= $0.05 ÷ $5.75 = 0.87% (rounded)

*Dividends per share = Common dividends ÷ Common shares (see above)

= $4,000 ÷ 80,000 shares = $0.05 per share (rounded)

u.Book value per share = Common stockholders' equity ÷ Number of common shares outstanding*

= $683,000 ÷ 80,000 shares = $8.54 per share (rounded)

*Number of common shares outstanding = Common stock ÷ Par value

= $160,000 ÷ $2 per share = 80,000 shares

Learning Objectives

- Undertake an analysis of a firm's liquidity by considering working capital, current ratio, and acid-test ratio.

- Determine company efficiency by investigating accounts receivable turnover, inventory turnover, and the operating cycle.

- Delve into and acknowledge the significance of various financial ratios.

Related questions

Steinkraus Corporation Has Provided the Following Data: Required ...

Neiger Corporation Has Provided the Following Financial Data ...

Fraction Corporation Has Provided the Following Financial Data: Required ...

Data from Yochem Corporation's Most Recent Balance Sheet Appear Below ...

Financial Statements for Praeger Corporation Appear Below: Dividends ...