Asked by Josie Pagnucco on Apr 29, 2024

Verified

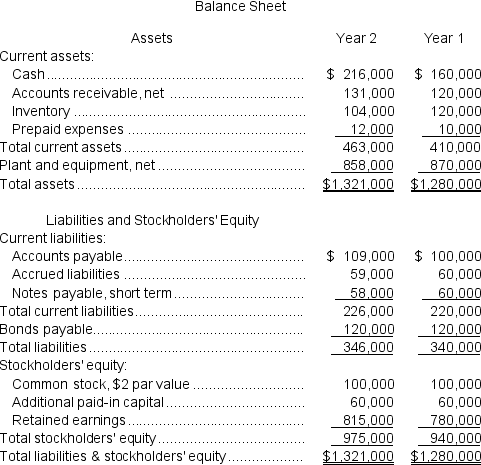

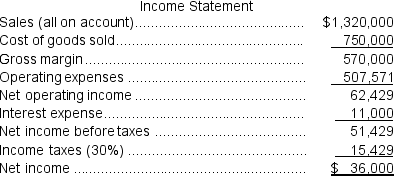

Neiger Corporation has provided the following financial data:

Required:

Required:

a.What is the company's working capital at the end of Year 2?

b.What is the company's current ratio at the end of Year 2?

c.What is the company's acid-test (quick)ratio at the end of Year 2?

d.What is the company's times interest earned ratio for Year 2?

e.What is the company's debt-to-equity ratio at the end of Year 2?

f.What is the company's equity multiplier at the end of Year 2?

Acid-test Ratio

A strict measure used to assess if a company possesses sufficient current assets to pay off its short-term obligations without the need to liquidate its stock.

Times Interest

A metric that evaluates a firm's capability to handle its debt responsibilities using its present earnings.

Equity Multiplier

A financial ratio that measures a company's use of debt financing by comparing total assets to shareholders' equity.

- Proceed with arithmetic evaluations and become aware of the significance of various financial metrics.

- Analyze the capability of a firm to manage its short-term financial needs by investigating working capital, current ratio, and acid-test ratio.

- Determine a company's leverage and risk through debt-to-equity ratio, equity multiplier, and times interest earned ratio.

Verified Answer

= $463,000 - $226,000 = $237,000

b.Current ratio = Current assets ÷ Current liabilities

= $463,000 ÷ $226,000 = 2.05 (rounded)

c.Acid-test (quick)ratio = Quick assets* ÷ Current liabilities

= $347,000 ÷ $226,000 = 1.54 (rounded)

*Quick assets = Cash + Marketable securities + Current receivables

= $216,000 + $0 + $131,000 = $347,000

d.Times interest earned = Earnings before interest expense and income taxes ÷ Interest expense

= $62,429 ÷ $11,000 = 5.68 (rounded)

e.Debt-to-equity ratio = Total liabilities ÷ Stockholders' equity

= $346,000 ÷ $975,000 = 0.35 (rounded)

f.Equity multiplier = Average total assets* ÷ Average stockholders' equity*

= $1,300,500 ÷ $957,500 = 1.36 (rounded)

*Average total assets = ($1,321,000 + $1,280,000)÷ 2 = $1,300,500

**Average stockholders' equity = ($975,000 + $940,000)÷ 2 = $957,500

Learning Objectives

- Proceed with arithmetic evaluations and become aware of the significance of various financial metrics.

- Analyze the capability of a firm to manage its short-term financial needs by investigating working capital, current ratio, and acid-test ratio.

- Determine a company's leverage and risk through debt-to-equity ratio, equity multiplier, and times interest earned ratio.

Related questions

Kisselburg Corporation Has Provided the Following Financial Data ...

Fraction Corporation Has Provided the Following Financial Data: Required ...

Gremel Corporation Has Provided the Following Financial Data: Required ...

Data from Yochem Corporation's Most Recent Balance Sheet Appear Below ...

Financial Statements for Praeger Corporation Appear Below: Dividends ...