Asked by Maryna chirilov on May 29, 2024

Verified

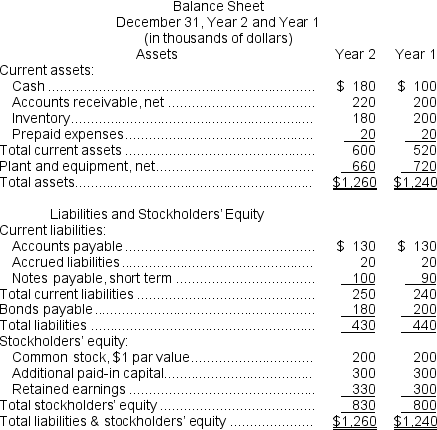

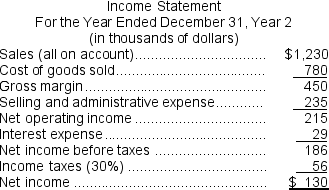

Sidell Corporation's most recent balance sheet and income statement appear below:

Required:

Required:

Compute the following for Year 2:

a.Times interest earned ratio.

b.Debt-to-equity ratio.

Debt-to-equity Ratio

A financial benchmark indicating the proportional use of debt and equity in the financing strategy for a company's assets.

Times Interest Earned Ratio

A financial metric assessing a company's ability to meet its interest obligations from operating earnings.

- Understand and apply various financial ratios to assess a company's financial health.

- Calculate and interpret the times interest earned ratio to evaluate a company's ability to meet its debt obligations.

- Compute and assess the debt-to-equity ratio to understand a company's financial leverage.

Verified Answer

MA

Maria AnagnostopoulosMay 29, 2024

Final Answer :

a.Times interest earned = Earnings before interest expense and income taxes ÷ Interest expense

= $215 ÷ $29 = 7.41

b.Debt-to-equity ratio = Total liabilities ÷ Stockholders' equity

= $430 ÷ $830 = 0.52

= $215 ÷ $29 = 7.41

b.Debt-to-equity ratio = Total liabilities ÷ Stockholders' equity

= $430 ÷ $830 = 0.52

Learning Objectives

- Understand and apply various financial ratios to assess a company's financial health.

- Calculate and interpret the times interest earned ratio to evaluate a company's ability to meet its debt obligations.

- Compute and assess the debt-to-equity ratio to understand a company's financial leverage.

Related questions

Remley Corporation Has Provided the Following Financial Data ...

Hagle Corporation Has Provided the Following Financial Data ...

Gehlhausen Corporation Has Provided the Following Financial Data ...

Which One of the Following Ratios Helps to Indicate a ...

Based Upon the Following Information, Which Company Has the Best ...