Asked by Hannah Baranda on May 29, 2024

Verified

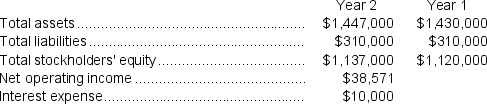

Fraction Corporation has provided the following financial data:  Required:

Required:

a.What is the company's times interest earned ratio for Year 2?

b.What is the company's debt-to-equity ratio at the end of Year 2?

c.What is the company's equity multiplier at the end of Year 2?

Debt-to-equity Ratio

The debt-to-equity ratio is a financial leverage indicator that compares a company's total liabilities to its shareholder equity.

Times Interest

This refers to the times interest earned (TIE) ratio, a financial metric used to measure a company's ability to meet its debt obligations with its earnings before interest and taxes (EBIT).

Equity Multiplier

A financial leverage ratio that measures the portion of a company's assets that is financed by stockholders' equity.

- Evaluate a corporation's leverage and potential financial risks using metrics such as the debt-to-equity ratio, equity multiplier, and times interest earned ratio.

Verified Answer

= $38,571 ÷ $10,000 = 3.86 (rounded)

b.Debt-to-equity ratio = Total liabilities ÷ Stockholders' equity

= $310,000 ÷ $1,137,000 = 0.27 (rounded)

c.Equity multiplier = Average total assets* ÷ Average stockholders' equity*

= $1,438,500 ÷ $1,128,500 = 1.27 (rounded)

*Average total assets = ($1,447,000 + $1,430,000)÷ 2 = $1,438,500

**Average stockholders' equity = ($1,137,000 + $1,120,000)÷ 2 = $1,128,500

Learning Objectives

- Evaluate a corporation's leverage and potential financial risks using metrics such as the debt-to-equity ratio, equity multiplier, and times interest earned ratio.

Related questions

Neiger Corporation Has Provided the Following Financial Data ...

Kisselburg Corporation Has Provided the Following Financial Data ...

Mahoe Corporation Has Provided the Following Financial Data: Dividends ...

Fraction Corporation Has Provided the Following Financial Data ...

Brill Corporation Has Provided the Following Financial Data ...