Asked by sourav saharan on Jul 03, 2024

Verified

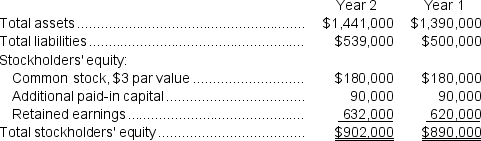

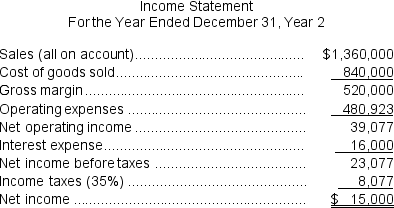

Remley Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $3,000.The market price of common stock at the end of Year 2 was $2.70 per share.

Dividends on common stock during Year 2 totaled $3,000.The market price of common stock at the end of Year 2 was $2.70 per share.

Required:

a.What is the company's times interest earned ratio for Year 2?

b.What is the company's debt-to-equity ratio at the end of Year 2?

c.What is the company's equity multiplier at the end of Year 2?

d.What is the company's earnings per share for Year 2?

e.What is the company's price-earnings ratio for Year 2?

f.What is the company's dividend payout ratio for Year 2?

g.What is the company's dividend yield ratio for Year 2?

h.What is the company's book value per share at the end of Year 2?

Equity Multiplier

A financial ratio indicating how much of a company's assets are financed by its shareholders' equity.

Debt-to-equity Ratio

This metric measures the relative contribution of shareholder equity and debt in the funding of a company's assets.

Dividend Yield Ratio

This ratio indicates the annual dividend payments of a company as a percentage of its current share price.

- Learn to understand and apply distinct financial ratios to check a company's financial condition.

- Carry out the computation and interpretation of the times interest earned ratio to understand a corporation's effectiveness at managing its debt duties.

- Execute calculations and assessments of the debt-to-equity ratio to gain insights into a corporation's financial leverage.

Verified Answer

= $39,077 ÷ $16,000 = 2.44 (rounded)

b.Debt-to-equity ratio = Total liabilities ÷ Stockholders' equity

= $539,000 ÷ $902,000 = 0.60 (rounded)

c.Equity multiplier = Average total assets* ÷ Average stockholders' equity*

= $1,415,500 ÷ $896,000 = 1.58 (rounded)

*Average total assets = ($1,441,000 + $1,390,000)÷ 2 = $1,415,500

**Average stockholders' equity = ($902,000 + $890,000)÷ 2 = $896,000

d.Earnings per share = Net Income ÷ Average number of common shares outstanding*

= $15,000 ÷ 60,000 shares = $0.25 per share (rounded)

*Number of common shares outstanding = Common stock ÷ Par value

= $180,000 ÷ $3 per share = 60,000 shares

e.Price-earnings ratio = Market price per share ÷ Earnings per share

= $2.70 ÷ $0.25 = 10.80 (rounded)

f.Dividend payout ratio = Dividends per share* ÷ Earnings per share

= $0.05 ÷ $0.25 = 20.0% (rounded)

*Dividends per share = Common dividends ÷ Common shares (see above)

= $3,000 ÷ 60,000 shares = $0.05 per share (rounded)

g.Dividend yield ratio = Dividends per share* ÷ Market price per share

= $0.05 ÷ $2.70 = 1.85% (rounded)

*Dividends per share = Common dividends ÷ Common shares (see above)

= $3,000 ÷ 60,000 shares = $0.05 per share (rounded)

h.Book value per share = Common stockholders' equity ÷ Number of common shares outstanding*

= $902,000 ÷ 60,000 shares = $15.03 per share (rounded)

*Number of common shares outstanding = Common stock ÷ Par value

= $180,000 ÷ $3 per share = 60,000 shares

Learning Objectives

- Learn to understand and apply distinct financial ratios to check a company's financial condition.

- Carry out the computation and interpretation of the times interest earned ratio to understand a corporation's effectiveness at managing its debt duties.

- Execute calculations and assessments of the debt-to-equity ratio to gain insights into a corporation's financial leverage.

Related questions

Sidell Corporation's Most Recent Balance Sheet and Income Statement Appear ...

Gehlhausen Corporation Has Provided the Following Financial Data ...

Hagle Corporation Has Provided the Following Financial Data ...

The Company's Equity Multiplier at the End of Year 2 ...

Based Upon the Following Information, Which Company Has the Best ...