Asked by Bailey McPhee on Apr 24, 2024

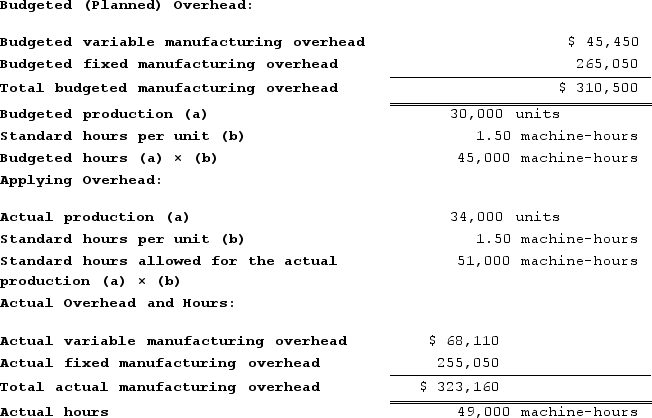

Hargett Incorporated makes a single product--an electrical motor used in many long-haul trucks. The company has a standard cost system in which it applies overhead to this product based on the standard machine-hours allowed for the actual output of the period. Data concerning the most recent year appear below:

Required:

Required:

a.Determine the variable overhead rate variance for the year.

b. Determine the variable overhead efficiency variance for the year.

c. Determine the fixed overhead budget variance for the year.

d. Determine the fixed overhead volume variance for the year.

e. Determine whether overhead was underapplied or overapplied for the year and by how much.

Variable Overhead

The indirect production costs that vary in total directly with changes in production volume or activity levels.

Overhead Efficiency

A measure of how effectively a business uses its fixed overheads to generate sales or production output.

Fixed Overhead Budget

A financial plan that forecasts the fixed overhead costs a company expects to incur, regardless of its level of output.

- Calculate various variances related to manufacturing overhead, including budget, volume, rate, and efficiency variances.

- Assess the impact of underapplied or overapplied overhead on financial performance.

Learning Objectives

- Calculate various variances related to manufacturing overhead, including budget, volume, rate, and efficiency variances.

- Assess the impact of underapplied or overapplied overhead on financial performance.

Related questions

Emanuele Incorporated Makes a Single Product--A Critical Part Used in ...

Stallbaumer Incorporated Makes a Single Product--An Electrical Motor Used in ...

Modine Corporation Has Provided the Following Data for September ...

Gaters Incorporated Makes a Single Product--An Electrical Motor Used in ...

Khat Incorporated Makes a Single Product--A Cooling Coil Used in ...