Asked by Antonio DjToniko on Apr 25, 2024

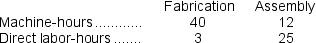

Huang Aerospace Corporation manufactures aviation control panels in two departments, Fabrication and Assembly.In the Fabrication department, Huang uses a predetermined overhead rate of $30 per machine-hour.In the Assembly department, Huang uses a predetermined overhead rate of $12 per direct labor-hour.During the current year, Job #X2984 incurred the following number of hours in each department:  What is the total amount of manufacturing overhead that Huang should have applied to Job #X2984 during the current year?

What is the total amount of manufacturing overhead that Huang should have applied to Job #X2984 during the current year?

A) $1,200

B) $1,500

C) $1,560

D) $1,734

Machine-Hours

A measurement used in cost accounting to allocate expenses to products or job orders, based on the number of hours machines are operated.

Direct Labor-Hours

An indicator of the cumulative hours spent by workers directly engaged in the production process.

- Execute the distribution of manufacturing overhead to jobs utilizing rates specific to each department.

Learning Objectives

- Execute the distribution of manufacturing overhead to jobs utilizing rates specific to each department.

Related questions

Marioni Corporation Has Two Manufacturing Departments--Forming and Assembly ...

Stoke Corporation Has Two Production Departments, Forming and Assembly ...

Heroux Corporation Has Two Manufacturing Departments--Forming and Customizing ...

Janicki Corporation Has Two Manufacturing Departments--Machining and Customizing ...

Thrall Corporation Uses a Job-Order Costing System with a Single ...