Asked by Julia Lavier on Jul 13, 2024

Verified

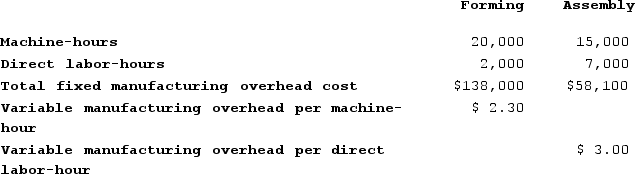

Stoke Corporation has two production departments, Forming and Assembly. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Forming Department's predetermined overhead rate is based on machine-hours and the Assembly Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job A460. The following data were recorded for this job:

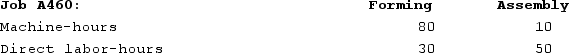

During the current month the company started and finished Job A460. The following data were recorded for this job:

The amount of overhead applied in the Assembly Department to Job A460 is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of overhead applied in the Assembly Department to Job A460 is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $415.00

B) $150.00

C) $565.00

D) $79,100.00

Overhead Applied

The allocation of overhead costs to produced goods based on a pre-determined rate or basis such as direct labor hours or machine hours.

Assembly Department

A part of a production facility where pieces are combined to form complete products.

Direct Labor-Hours

Direct labor-hours measure the amount of time workers or employees spend directly working on producing goods or providing services.

- Use pre-calculated overhead rates to assign manufacturing overhead costs to jobs.

Verified Answer

Predetermined overhead rate for Assembly Department = Estimated overhead costs / Estimated direct labor-hours = $210,000 / 21,000 direct labor-hours = $10.00 per direct labor-hour.

The Forming Department used 800 machine hours (given in the table). The Assembly Department used 50 direct labor-hours (given in the table).

The amount of overhead applied to Job A460 in the Forming Department is:

$4.00 per machine hour × 650 machine hours used = $2,600.00

The amount of overhead applied to Job A460 in the Assembly Department is:

$10.00 per direct labor-hour × 50 direct labor-hours used = $500.00

Therefore, the total overhead applied to Job A460 is $2,600.00 + $500.00 = $3,100.00.

Hence, the amount of overhead applied in the Assembly Department to Job A460 is $500.00, which is closest to option C ($565.00) but it may be a bit lower because some of the overhead applied to the Forming Department may actually be used in the Assembly Department.

Learning Objectives

- Use pre-calculated overhead rates to assign manufacturing overhead costs to jobs.

Related questions

Heroux Corporation Has Two Manufacturing Departments--Forming and Customizing ...

Janicki Corporation Has Two Manufacturing Departments--Machining and Customizing ...

Valvano Corporation Uses a Job-Order Costing System with a Single ...

Session Corporation Uses a Job-Order Costing System with a Single ...

Trevigne Corporation Uses a Predetermined Overhead Rate Base on Machine-Hours ...