Asked by Kevin Vadakkel on May 09, 2024

Verified

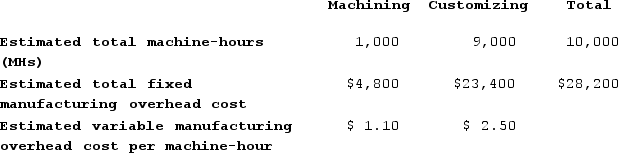

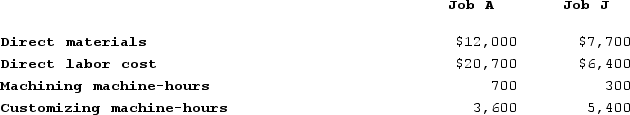

Janicki Corporation has two manufacturing departments--Machining and Customizing. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  During the most recent month, the company started and completed two jobs--Job A and Job J. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job A and Job J. There were no beginning inventories. Data concerning those two jobs follow:

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 50% on manufacturing cost to establish selling prices. The calculated selling price for Job A is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 50% on manufacturing cost to establish selling prices. The calculated selling price for Job A is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $27,595

B) $87,752

C) $82,785

D) $55,190

Departmental Predetermined Rates

Overhead allocation rates set in advance for specific departments to allocate indirect costs more accurately.

Markup

An additional amount included in the cost price of products to account for overheads and gain, thereby establishing the price at which they are sold.

Machine-Hours

The total number of hours machines are operated during the production process.

- Implement the assignment of manufacturing overhead to job orders using pre-calculated rates.

- Implement markups to figure out the selling rate of manufactured products.

- Differentiate between plantwide and departmental overhead rates and their impact on product costing.

Verified Answer

Manufacturing Cost = Direct Materials + Direct Labor + Overhead

For Job A:

Direct Materials = $24,930

Direct Labor = $5,650

Overhead = Machining OH Rate x Machining Machine-Hours + Customizing OH Rate x Customizing Machine-Hours

= $18.00 x 1,000 MH + $15.00 x 700 MH

= $18,000 + $10,500

= $28,500

Manufacturing Cost for Job A = $24,930 + $5,650 + $28,500 = $59,080

For Job J:

Direct Materials = $78,300

Direct Labor = $9,000

Overhead = Machining OH Rate x Machining Machine-Hours + Customizing OH Rate x Customizing Machine-Hours

= $18.00 x 2,000 MH + $15.00 x 1,200 MH

= $36,000 + $18,000

= $54,000

Manufacturing Cost for Job J = $78,300 + $9,000 + $54,000 = $141,300

Next, we need to calculate the total cost and selling price for each job, using the 50% markup:

Total Cost = Manufacturing Cost x 150%

Selling Price = Total Cost

For Job A:

Total Cost = $59,080 x 150% = $88,620

Selling Price for Job A = $88,620

For Job J:

Total Cost = $141,300 x 150% = $211,950

Selling Price for Job J = $211,950

Therefore, the calculated selling price for Job A is closest to $82,785 (rounded to the nearest dollar), and the correct answer is C.

Learning Objectives

- Implement the assignment of manufacturing overhead to job orders using pre-calculated rates.

- Implement markups to figure out the selling rate of manufactured products.

- Differentiate between plantwide and departmental overhead rates and their impact on product costing.

Related questions

Heroux Corporation Has Two Manufacturing Departments--Forming and Customizing ...

Stoke Corporation Has Two Production Departments, Forming and Assembly ...

Session Corporation Uses a Job-Order Costing System with a Single ...

Valvano Corporation Uses a Job-Order Costing System with a Single ...

Thrall Corporation Uses a Job-Order Costing System with a Single ...