Asked by levana znaty on May 28, 2024

Verified

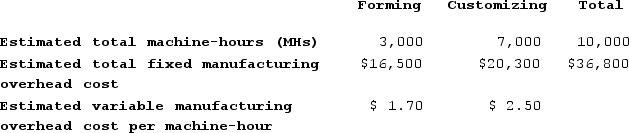

Heroux Corporation has two manufacturing departments--Forming and Customizing. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  During the most recent month, the company started and completed two jobs--Job A and Job H. There were no beginning inventories. Data concerning those two jobs follow:

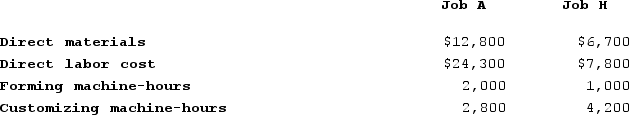

During the most recent month, the company started and completed two jobs--Job A and Job H. There were no beginning inventories. Data concerning those two jobs follow:

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. The manufacturing overhead applied to Job H is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. The manufacturing overhead applied to Job H is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $22,680

B) $30,888

C) $29,880

D) $7,200

Departmental Predetermined Rates

The estimated overhead rates calculated for specific departments within a company to allocate costs appropriately.

Manufacturing Overhead

All indirect factory-related costs incurred during the production process, excluding direct materials and direct labor.

Machine-Hours

A measure of the amount of time machines are utilized during the production process.

- Apply preset rates to assign manufacturing overhead costs to various jobs.

- Outline the variance between plantwide and departmental overhead rates in their effect on product cost determination.

Verified Answer

For the Forming department:

Predetermined overhead rate = $192,000 / 96,000 = $2.00 per machine-hour

Machine-hours used for Job H = 8,000

Manufacturing overhead applied = $2.00 x 8,000 = $16,000

For the Customizing department:

Predetermined overhead rate = $240,000 / 120,000 = $2.00 per machine-hour

Machine-hours used for Job H = 9,000

Manufacturing overhead applied = $2.00 x 9,000 = $18,000

Total manufacturing overhead applied to Job H = $16,000 + $18,000 = $29,880.

Therefore, the closest option is C.

Learning Objectives

- Apply preset rates to assign manufacturing overhead costs to various jobs.

- Outline the variance between plantwide and departmental overhead rates in their effect on product cost determination.

Related questions

Stoke Corporation Has Two Production Departments, Forming and Assembly ...

Janicki Corporation Has Two Manufacturing Departments--Machining and Customizing ...

Valvano Corporation Uses a Job-Order Costing System with a Single ...

Session Corporation Uses a Job-Order Costing System with a Single ...

Thrall Corporation Uses a Job-Order Costing System with a Single ...