Asked by Nirvir Khosa on Apr 29, 2024

Verified

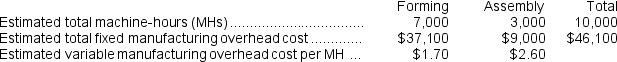

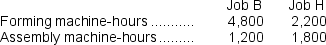

Marioni Corporation has two manufacturing departments--Forming and Assembly.The company used the following data at the beginning of the year to calculate predetermined overhead rates:  During the most recent month, the company started and completed two jobs--Job B and Job H.There were no beginning inventories.Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job B and Job H.There were no beginning inventories.Data concerning those two jobs follow:  Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments.The manufacturing overhead applied to Job B is closest to:

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments.The manufacturing overhead applied to Job B is closest to:

A) $6,720

B) $33,600

C) $40,320

D) $39,480

Departmental Predetermined Overhead Rates

These rates are calculated to allocate manufacturing overhead costs to specific departments, based on estimated or actual overhead and activity levels.

Machine-Hours

A measure of production time using machinery; used as a basis for allocating manufacturing overhead costs to products.

- Distribute manufacturing overhead across jobs by implementing rates specific to departments.

- Evaluate the entire cost associated with executing a job, factoring in expenses related to direct materials, direct labor, and the overhead applied.

Verified Answer

ZK

Zybrea KnightMay 04, 2024

Final Answer :

C

Explanation :

To calculate the manufacturing overhead applied to Job B, we need to first calculate the predetermined overhead rate for each department.

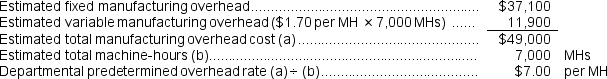

Forming Department:

Predetermined overhead rate = Estimated total manufacturing overhead cost / Estimated total machine-hours

= ($396,000 + $68,400) / 12,000 machine-hours

= $40 per machine-hour

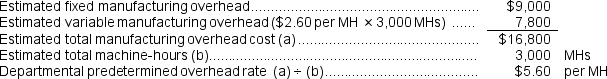

Assembly Department:

Predetermined overhead rate = Estimated total manufacturing overhead cost / Estimated total machine-hours

= ($284,400 + $68,400) / 8,000 machine-hours

= $43 per machine-hour

Next, we can calculate the manufacturing overhead applied to Job B in each department:

Forming Department:

Manufacturing overhead applied to Job B = Predetermined overhead rate × Actual machine-hours used

= $40 per machine-hour × 800 machine-hours

= $32,000

Assembly Department:

Manufacturing overhead applied to Job B = Predetermined overhead rate × Actual machine-hours used

= $43 per machine-hour × 600 machine-hours

= $25,800

Total manufacturing overhead applied to Job B = Manufacturing overhead applied in Forming Department + Manufacturing overhead applied in Assembly Department

= $32,000 + $25,800

= $57,800

Therefore, the manufacturing overhead applied to Job B is closest to $40,320 (option C).

Forming Department:

Predetermined overhead rate = Estimated total manufacturing overhead cost / Estimated total machine-hours

= ($396,000 + $68,400) / 12,000 machine-hours

= $40 per machine-hour

Assembly Department:

Predetermined overhead rate = Estimated total manufacturing overhead cost / Estimated total machine-hours

= ($284,400 + $68,400) / 8,000 machine-hours

= $43 per machine-hour

Next, we can calculate the manufacturing overhead applied to Job B in each department:

Forming Department:

Manufacturing overhead applied to Job B = Predetermined overhead rate × Actual machine-hours used

= $40 per machine-hour × 800 machine-hours

= $32,000

Assembly Department:

Manufacturing overhead applied to Job B = Predetermined overhead rate × Actual machine-hours used

= $43 per machine-hour × 600 machine-hours

= $25,800

Total manufacturing overhead applied to Job B = Manufacturing overhead applied in Forming Department + Manufacturing overhead applied in Assembly Department

= $32,000 + $25,800

= $57,800

Therefore, the manufacturing overhead applied to Job B is closest to $40,320 (option C).

Explanation :

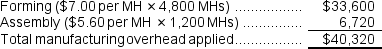

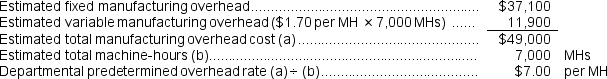

Forming Department predetermined overhead rate:  Assembly Department predetermined overhead rate:

Assembly Department predetermined overhead rate:  Manufacturing overhead applied to Job B:

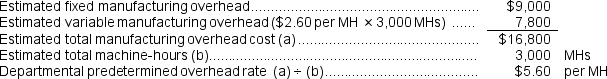

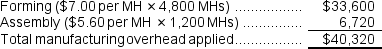

Manufacturing overhead applied to Job B:

Assembly Department predetermined overhead rate:

Assembly Department predetermined overhead rate:  Manufacturing overhead applied to Job B:

Manufacturing overhead applied to Job B:

Learning Objectives

- Distribute manufacturing overhead across jobs by implementing rates specific to departments.

- Evaluate the entire cost associated with executing a job, factoring in expenses related to direct materials, direct labor, and the overhead applied.

Related questions

Huang Aerospace Corporation Manufactures Aviation Control Panels in Two Departments ...

Dietzen Corporation Has Two Manufacturing Departments--Casting and Finishing ...

Placker Corporation Uses a Job-Order Costing System with a Single ...

Grib Corporation Uses a Predetermined Overhead Rate Based on Direct ...

The Job Cost Sheet for Job Number 83-421 Includes the ...