Asked by seydi ortiz on Apr 25, 2024

Verified

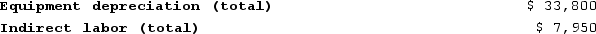

Howell Corporation's activity-based costing system has three activity cost pools--Machining, Setting Up, and Other. The company's overhead costs, which consist of equipment depreciation and indirect labor, are allocated to the cost pools in proportion to the activity cost pools' consumption of resources.

Distribution of Resource Consumption Across Activity Cost Pools

Distribution of Resource Consumption Across Activity Cost Pools

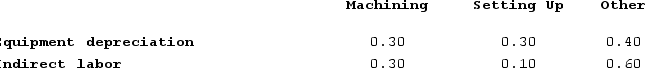

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products.

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products.

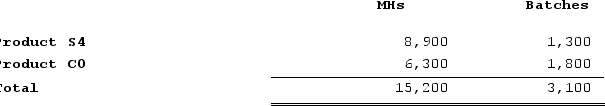

Additional data concerning the company's products appears below:

Additional data concerning the company's products appears below:

Required:a. Assign overhead costs to activity cost pools using activity-based costing. b. Calculate activity rates for each activity cost pool using activity-based costing. c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. d. Determine the product margins for each product using activity-based costing.

Required:a. Assign overhead costs to activity cost pools using activity-based costing. b. Calculate activity rates for each activity cost pool using activity-based costing. c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. d. Determine the product margins for each product using activity-based costing.

Activity-Based Costing

Activity-based costing is an accounting method that assigns costs to products and services based on the activities and resources that go into producing them.

Equipment Depreciation

The allocation of the cost of physical assets over its useful life, recognizing wear and tear over time.

Activity Cost Pools

Groupings of all costs associated with particular activities, which are then allocated to products or services based on their use of those activities.

- Execute precise allocation of indirect costs to products by implementing activity-based costing methods.

- Determine product margins using activity-based costing methodologies.

Verified Answer

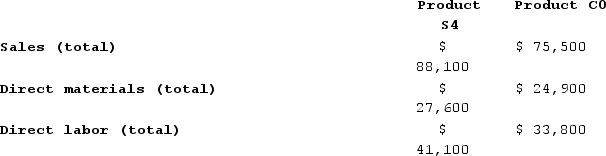

![a.Assign overhead costs to activity cost pools by applying the percentages in the Distribution of Resource Consumption Across Activity Cost Pools table to the respective costs. For example, the first entry in the table is computed as follows: {{[a(3)]:#,##0.00}} × ${{[a(1)]:#,###}} = ${{[a(21)]:#,###}}. b.Computation of activity rates: c.Assign overhead costs to products:Overhead cost for Product S4: Overhead cost for Product C0: d.Determine product margins:](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61a7_bc7a_bf83_8dfe3b123775_TB8314_00.jpg) b.Computation of activity rates:

b.Computation of activity rates:![a.Assign overhead costs to activity cost pools by applying the percentages in the Distribution of Resource Consumption Across Activity Cost Pools table to the respective costs. For example, the first entry in the table is computed as follows: {{[a(3)]:#,##0.00}} × ${{[a(1)]:#,###}} = ${{[a(21)]:#,###}}. b.Computation of activity rates: c.Assign overhead costs to products:Overhead cost for Product S4: Overhead cost for Product C0: d.Determine product margins:](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61a7_bc7b_bf83_09cc48cc5315_TB8314_00.jpg) c.Assign overhead costs to products:Overhead cost for Product S4:

c.Assign overhead costs to products:Overhead cost for Product S4:![a.Assign overhead costs to activity cost pools by applying the percentages in the Distribution of Resource Consumption Across Activity Cost Pools table to the respective costs. For example, the first entry in the table is computed as follows: {{[a(3)]:#,##0.00}} × ${{[a(1)]:#,###}} = ${{[a(21)]:#,###}}. b.Computation of activity rates: c.Assign overhead costs to products:Overhead cost for Product S4: Overhead cost for Product C0: d.Determine product margins:](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61a7_bc7c_bf83_01dc70bef8a2_TB8314_00.jpg) Overhead cost for Product C0:

Overhead cost for Product C0:![a.Assign overhead costs to activity cost pools by applying the percentages in the Distribution of Resource Consumption Across Activity Cost Pools table to the respective costs. For example, the first entry in the table is computed as follows: {{[a(3)]:#,##0.00}} × ${{[a(1)]:#,###}} = ${{[a(21)]:#,###}}. b.Computation of activity rates: c.Assign overhead costs to products:Overhead cost for Product S4: Overhead cost for Product C0: d.Determine product margins:](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61a7_bc7d_bf83_37a49dfa5488_TB8314_00.jpg) d.Determine product margins:

d.Determine product margins:![a.Assign overhead costs to activity cost pools by applying the percentages in the Distribution of Resource Consumption Across Activity Cost Pools table to the respective costs. For example, the first entry in the table is computed as follows: {{[a(3)]:#,##0.00}} × ${{[a(1)]:#,###}} = ${{[a(21)]:#,###}}. b.Computation of activity rates: c.Assign overhead costs to products:Overhead cost for Product S4: Overhead cost for Product C0: d.Determine product margins:](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61a7_bc7e_bf83_2fda558e0b23_TB8314_00.jpg)

Learning Objectives

- Execute precise allocation of indirect costs to products by implementing activity-based costing methods.

- Determine product margins using activity-based costing methodologies.

Related questions

Groleau Corporation Has an Activity-Based Costing System with Three Activity ...

The Following Data Have Been Provided by Hooey Corporation from ...

Figge and Mathews PLC, a Consulting Firm, Uses an Activity-Based ...

Mcnamee Corporation's Activity-Based Costing System Has Three Activity Cost Pools--Fabricating ...

EMD Corporation Manufactures Two Products, Product S and Product W ...