Asked by Susana Guerrero on May 16, 2024

Verified

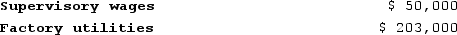

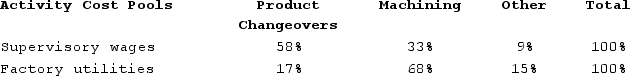

The following data have been provided by Hooey Corporation from its activity-based costing accounting system:

Distribution of Resource Consumption across Activity Cost Pools:

Distribution of Resource Consumption across Activity Cost Pools:

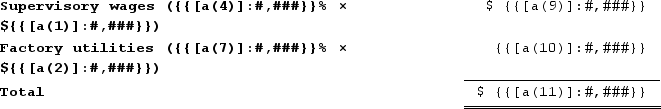

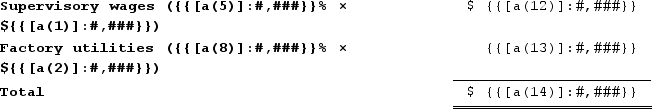

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.Required:a. Determine the total amount of supervisory wages and factory utilities costs that would be allocated to the Machining activity cost pool.b. Determine the total amount of supervisory wages and factory utilities costs that would NOT be assigned to products.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.Required:a. Determine the total amount of supervisory wages and factory utilities costs that would be allocated to the Machining activity cost pool.b. Determine the total amount of supervisory wages and factory utilities costs that would NOT be assigned to products.

Activity-Based Costing

An accounting technique that pinpoints activities within a company and allocates the expenses of each activity to every product and service based on their actual usage.

Activity Cost Pool

A collection of all costs associated with a particular business activity or group of activities.

Resource Consumption

The use of resources, such as time, materials, and labor, in the production of goods or the provision of services.

- Allocate indirect costs to products using activity-based costing accurately.

- Understand the difference between assigning costs to products and not assigning costs.

Verified Answer

b. As stated in the problem, the costs allocated to the "Other" cost pool are not assigned to products.

b. As stated in the problem, the costs allocated to the "Other" cost pool are not assigned to products.

Learning Objectives

- Allocate indirect costs to products using activity-based costing accurately.

- Understand the difference between assigning costs to products and not assigning costs.

Related questions

Groleau Corporation Has an Activity-Based Costing System with Three Activity ...

Desilets Corporation Has Provided the Following Data from Its Activity-Based ...

Mcnamee Corporation's Activity-Based Costing System Has Three Activity Cost Pools--Fabricating ...

Beckley Corporation Has Provided the Following Data from Its Activity-Based ...

Figge and Mathews PLC, a Consulting Firm, Uses an Activity-Based ...