Asked by Stacie Batchelor on May 01, 2024

Verified

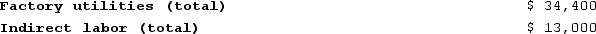

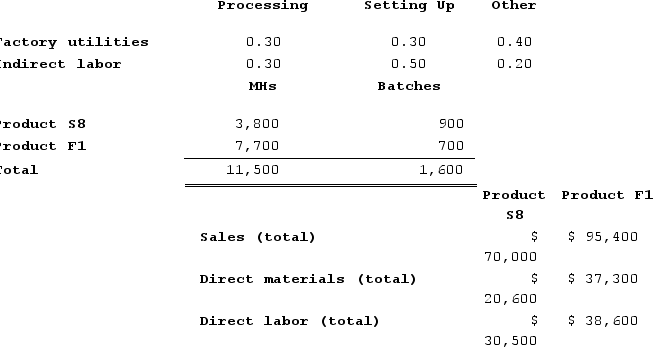

Groleau Corporation has an activity-based costing system with three activity cost pools--Processing, Setting Up, and Other. The company's overhead costs, which consist of factory utilities and indirect labor, are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Costs in the Processing cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs and activity-based costing system appear below:

Distribution of Resource Consumption Across Activity Cost Pools

Distribution of Resource Consumption Across Activity Cost Pools

Required:a. Assign overhead costs to activity cost pools using activity-based costing. b. Calculate activity rates for each activity cost pool using activity-based costing. c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. d. Determine the product margins for each product using activity-based costing.

Required:a. Assign overhead costs to activity cost pools using activity-based costing. b. Calculate activity rates for each activity cost pool using activity-based costing. c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. d. Determine the product margins for each product using activity-based costing.

Activity-Based Costing

A costing methodology that assigns overhead and indirect costs to specific activities, providing more accurate product or service costs.

Activity Cost Pools

These are groupings of individual costs, based on the activities that drive costs in an organization, which are used in activity-based costing to allocate costs more accurately.

Machine-Hours

A measure of production time, quantifying the number of hours machines are operating in the manufacturing process.

- Employ activity-based costing to accurately allocate indirect expenses to various products.

- Establish product margins by utilizing activity-based costing strategies.

Verified Answer

![a. Assign overhead costs to activity cost pools by applying the percentages in the Distribution of Resource Consumption Across Activity Cost Pools table to the respective costs. For example, the first entry in the table is computed as follows: {{[a(3)]:#,##0.00}} × ${{[a(1)]:#,###}} = ${{[a(21)]:#,###}}. b. Computation of activity rates: c. Assign overhead costs to products:Overhead cost for Product S8: Overhead cost for Product F1: d. Determine product margins:](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61a7_6e51_bf83_3b971e3ee9dd_TB8314_00.jpg) b. Computation of activity rates:

b. Computation of activity rates:![a. Assign overhead costs to activity cost pools by applying the percentages in the Distribution of Resource Consumption Across Activity Cost Pools table to the respective costs. For example, the first entry in the table is computed as follows: {{[a(3)]:#,##0.00}} × ${{[a(1)]:#,###}} = ${{[a(21)]:#,###}}. b. Computation of activity rates: c. Assign overhead costs to products:Overhead cost for Product S8: Overhead cost for Product F1: d. Determine product margins:](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61a7_6e52_bf83_cd0c1d34b587_TB8314_00.jpg) c. Assign overhead costs to products:Overhead cost for Product S8:

c. Assign overhead costs to products:Overhead cost for Product S8:![a. Assign overhead costs to activity cost pools by applying the percentages in the Distribution of Resource Consumption Across Activity Cost Pools table to the respective costs. For example, the first entry in the table is computed as follows: {{[a(3)]:#,##0.00}} × ${{[a(1)]:#,###}} = ${{[a(21)]:#,###}}. b. Computation of activity rates: c. Assign overhead costs to products:Overhead cost for Product S8: Overhead cost for Product F1: d. Determine product margins:](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61a7_6e53_bf83_55641486ca02_TB8314_00.jpg) Overhead cost for Product F1:

Overhead cost for Product F1:![a. Assign overhead costs to activity cost pools by applying the percentages in the Distribution of Resource Consumption Across Activity Cost Pools table to the respective costs. For example, the first entry in the table is computed as follows: {{[a(3)]:#,##0.00}} × ${{[a(1)]:#,###}} = ${{[a(21)]:#,###}}. b. Computation of activity rates: c. Assign overhead costs to products:Overhead cost for Product S8: Overhead cost for Product F1: d. Determine product margins:](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61a7_6e54_bf83_e59cfe1d5788_TB8314_00.jpg) d. Determine product margins:

d. Determine product margins:![a. Assign overhead costs to activity cost pools by applying the percentages in the Distribution of Resource Consumption Across Activity Cost Pools table to the respective costs. For example, the first entry in the table is computed as follows: {{[a(3)]:#,##0.00}} × ${{[a(1)]:#,###}} = ${{[a(21)]:#,###}}. b. Computation of activity rates: c. Assign overhead costs to products:Overhead cost for Product S8: Overhead cost for Product F1: d. Determine product margins:](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61a7_6e55_bf83_a9bddfa7d658_TB8314_00.jpg)

Learning Objectives

- Employ activity-based costing to accurately allocate indirect expenses to various products.

- Establish product margins by utilizing activity-based costing strategies.

Related questions

Figge and Mathews PLC, a Consulting Firm, Uses an Activity-Based ...

Mcnamee Corporation's Activity-Based Costing System Has Three Activity Cost Pools--Fabricating ...

Musich Corporation Has an Activity-Based Costing System with Three Activity ...

Beckley Corporation Has Provided the Following Data from Its Activity-Based ...

Moorman Corporation Has an Activity-Based Costing System with Three Activity ...