Asked by Christine Angora on May 18, 2024

Verified

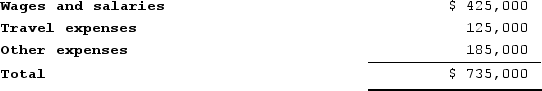

Figge and Mathews PLC, a consulting firm, uses an activity-based costing in which there are three activity cost pools. The company has provided the following data concerning its costs and its activity based costing system:Costs:

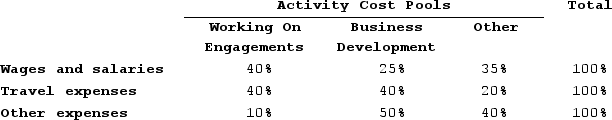

Distribution of resource consumption:

Distribution of resource consumption:

Required:a. How much cost, in total, would be allocated to the Working On Engagements activity cost pool? b. How much cost, in total, would be allocated to the Business Development activity cost pool? c. How much cost, in total, would be allocated to the Other activity cost pool?

Required:a. How much cost, in total, would be allocated to the Working On Engagements activity cost pool? b. How much cost, in total, would be allocated to the Business Development activity cost pool? c. How much cost, in total, would be allocated to the Other activity cost pool?

Activity-Based Costing

An accounting method that assigns overhead and indirect costs to related products and services based on the activities that generate costs.

Activity Cost Pools

Accumulations of costs categorized by activity (such as ordering materials or setting up machines), used in activity-based costing to allocate costs more accurately.

Resource Consumption

The amount of resources used by an organization or process, often analyzed for efficiency improvements or environmental impact.

- Through the application of activity-based costing, ensure accurate assignment of indirect costs to products.

Verified Answer

![All three parts can be answered using a first-stage allocation of costs. The amount in each cell in the table below is computed by multiplying the cost for the category by the percentage for the activity. For example, ${{[a(14)]:#,###}} is equal to ${{[a(1)]:#,###}} multiplied by {{[a(29)]:#,##0.00}}.](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_61a7_202b_bf83_97e780ff2b3f_TB8314_00.jpg)

Learning Objectives

- Through the application of activity-based costing, ensure accurate assignment of indirect costs to products.

Related questions

Groleau Corporation Has an Activity-Based Costing System with Three Activity ...

Desilets Corporation Has Provided the Following Data from Its Activity-Based ...

Mcnamee Corporation's Activity-Based Costing System Has Three Activity Cost Pools--Fabricating ...

Musich Corporation Has an Activity-Based Costing System with Three Activity ...

The Following Data Have Been Provided by Hooey Corporation from ...