Asked by Daylanie Flores on May 12, 2024

Verified

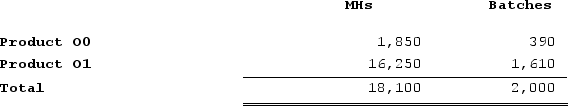

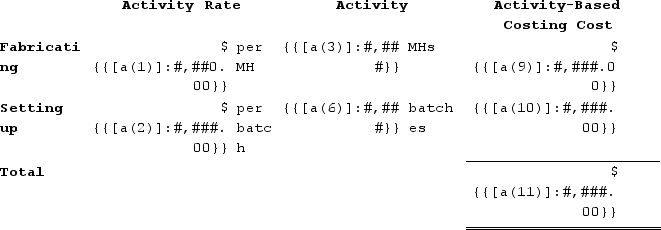

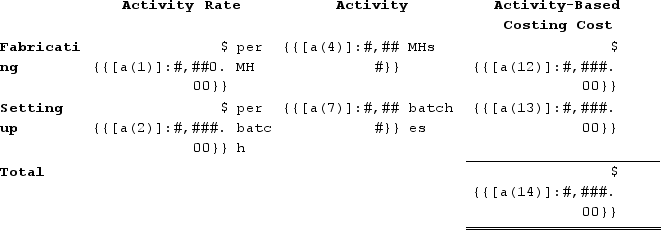

Mcnamee Corporation's activity-based costing system has three activity cost pools--Fabricating, Setting Up, and Other. Costs in the Fabricating cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The activity rate for Fabricating is $0.33 per machine-hour; the activity rate for Setting Up is $3.49 per batch. The following table shows the machine-hours and number of batches associated with each of the company's two products:

Required:Determine the amount of overhead cost that would be assigned to each product using activity-based costing. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.)

Required:Determine the amount of overhead cost that would be assigned to each product using activity-based costing. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.)

Activity-Based Costing

A pricing strategy that pinpoints various tasks within a company and allocates the expense of each task across all goods and services based on their real usage.

Batches

Groups of items or materials processed or produced together in a manufacturing or production process.

- Apply activity-based costing to accurately attribute indirect costs to products.

Verified Answer

Overhead cost for Product O1:

Overhead cost for Product O1:

Learning Objectives

- Apply activity-based costing to accurately attribute indirect costs to products.

Related questions

Groleau Corporation Has an Activity-Based Costing System with Three Activity ...

Desilets Corporation Has Provided the Following Data from Its Activity-Based ...

Desilets Corporation Has Provided the Following Data from Its Activity-Based ...

Musich Corporation Has an Activity-Based Costing System with Three Activity ...

Beckley Corporation Has Provided the Following Data from Its Activity-Based ...