Asked by Richard Sullivan on May 20, 2024

Verified

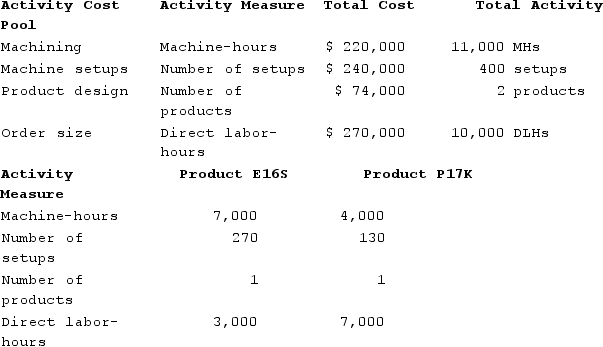

Weissman Corporation manufactures two products: Product E16S and Product P17K. The company is considering implementing an activity-based costing (ABC) system that allocates its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products E16S and P17K.  Using the ABC system, the percentage of the total overhead cost that is assigned to Product E16S is closest to:

Using the ABC system, the percentage of the total overhead cost that is assigned to Product E16S is closest to:

A) 52.24%

B) 42.16%

C) 10.07%

D) 50.00%

Activity-Based Costing

This costing method assigns overhead and indirect costs to specific activities, thus providing a more accurate reflection of the costs associated with producing specific products or services.

Manufacturing Overhead

All manufacturing costs that are not directly associated with the production of a product, including indirect materials, indirect labor, and other expenses such as depreciation and maintenance.

- Ascertain the percentage of overall overhead expenditure apportioned to specific items using data from Activity-Based Costing (ABC).

Verified Answer

Product E16S = $1,656,000 (cost pool 1) + $2,080,000 (cost pool 2) + $960,000 (cost pool 3) + $1,024,000 (cost pool 4) = $5,720,000

Product P17K = $2,352,000 (cost pool 1) + $1,760,000 (cost pool 2) + $1,040,000 (cost pool 3) + $640,000 (cost pool 4) = $5,792,000

The percentage of total overhead cost assigned to Product E16S can be calculated as:

($5,720,000 / ($5,720,000 + $5,792,000)) x 100% = 49.74% (rounded to two decimal places)

Therefore, the closest answer choice is A) 52.24%, which is the percentage of total overhead cost assigned to Product P17K.

Learning Objectives

- Ascertain the percentage of overall overhead expenditure apportioned to specific items using data from Activity-Based Costing (ABC).

Related questions

Fletes Corporation Manufactures Two Products: Product O95C and Product M31N ...

Horgen Corporation Manufactures Two Products: Product M68B and Product H27T ...

Addleman Corporation Has an Activity-Based Costing System with Three Activity ...

Deemer Corporation Has an Activity-Based Costing System with Three Activity ...

Doede Corporation Uses Activity-Based Costing to Compute Product Margins ...