Asked by Margaret Marshall on Jun 13, 2024

Verified

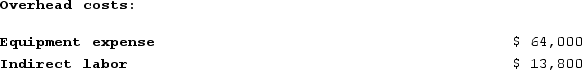

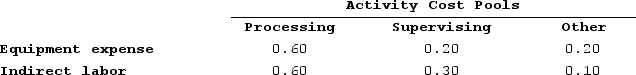

Deemer Corporation has an activity-based costing system with three activity cost pools--Processing, Supervising, and Other. In the first stage allocations, costs in the two overhead accounts, equipment expense and indirect labor, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

Distribution of Resource Consumption Across Activity Cost Pools:

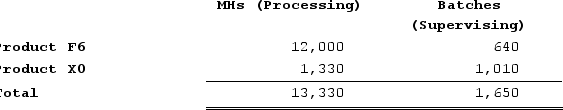

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

What is the overhead cost assigned to Product X0 under activity-based costing? (Round your intermediate calculations to 2 decimal places.)

What is the overhead cost assigned to Product X0 under activity-based costing? (Round your intermediate calculations to 2 decimal places.)

A) $4,655

B) $15,028

C) $10,373

D) $25,006

Overhead Cost

All indirect costs associated with the operation of a business, including administrative expenses, depreciation, and utilities.

Activity-Based Costing

A costing methodology that identifies activities in an organization and assigns the cost of each activity to all products and services according to the actual consumption.

Machine-Hours

A measure of production time, calculated by multiplying the number of machines used by the number of hours they operate.

- Assess the overhead cost attributed to products within the Activity-Based Costing system.

Verified Answer

Processing: $74,250 ÷ 2,970 MHs = $25 per MH

Supervising: $35,000 ÷ 70 batches = $500 per batch

Next, we need to calculate the total amount of overhead assigned to each product for each activity.

For Product X0:

Processing: 500 MHs × $25 per MH = $12,500

Supervising: 20 batches × $500 per batch = $10,000

Therefore, the overhead cost assigned to Product X0 under activity-based costing is:

$12,500 + $10,000 = $22,500

However, we also need to add the Other activity cost pool, which is not assigned to products, but must still be included in the total overhead cost. From the first stage allocations, we know that the total cost in the Other activity cost pool is $17,500. Therefore, the total overhead cost assigned to Product X0 under activity-based costing is:

$22,500 + $17,500 = $40,000

Finally, we need to divide the total overhead cost by the number of units produced to get the overhead cost per unit.

$40,000 ÷ 2,685 units = $14.89 per unit

Therefore, the final answer is:

B) $15,028 (rounded to the nearest dollar)

Learning Objectives

- Assess the overhead cost attributed to products within the Activity-Based Costing system.

Related questions

Doede Corporation Uses Activity-Based Costing to Compute Product Margins ...

Meester Corporation Has an Activity-Based Costing System with Three Activity ...

Addleman Corporation Has an Activity-Based Costing System with Three Activity ...

Doede Corporation Uses Activity-Based Costing to Compute Product Margins ...

Bartow Corporation Uses an Activity Based Costing System to Assign ...