Asked by Caden Coulson on Jun 16, 2024

Verified

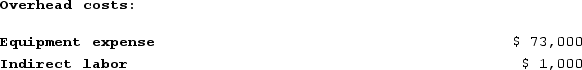

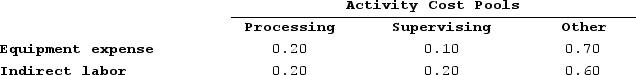

Addleman Corporation has an activity-based costing system with three activity cost pools--Processing, Supervising, and Other. In the first stage allocations, costs in the two overhead accounts, equipment expense and indirect labor, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

Distribution of Resource Consumption Across Activity Cost Pools:

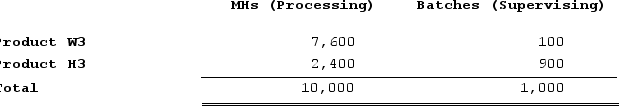

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

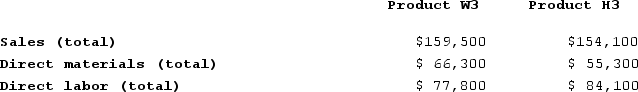

Finally, the costs of Processing and Supervising are combined with the following sales and direct cost data to determine product margins.Sales and Direct Cost Data:

Finally, the costs of Processing and Supervising are combined with the following sales and direct cost data to determine product margins.Sales and Direct Cost Data:

How much overhead cost is allocated to the Supervising activity cost pool under activity-based costing?

How much overhead cost is allocated to the Supervising activity cost pool under activity-based costing?

A) $7,300

B) $51,700

C) $7,500

D) $200

Supervising Activity

The process of overseeing and directing work activities and tasks to ensure they are executed efficiently and effectively, typically within a workplace.

Activity-Based Costing

A costing method that assigns costs to products and services based on the activities and resources that go into creating them.

Overhead Cost

Refers to all ongoing business expenses not directly tied to producing a specific product or service, such as rent, utilities, and administrative salaries.

- Estimate the overhead charges assigned to products under an Activity-Based Costing framework.

Verified Answer

Processing: 40% x $220,000 = $88,000

Supervising: 60% x $220,000 = $132,000

Other: Not assigned to products

Therefore, $132,000 is allocated to the Supervising activity cost pool.

Learning Objectives

- Estimate the overhead charges assigned to products under an Activity-Based Costing framework.

Related questions

Doede Corporation Uses Activity-Based Costing to Compute Product Margins ...

Meester Corporation Has an Activity-Based Costing System with Three Activity ...

Deemer Corporation Has an Activity-Based Costing System with Three Activity ...

Doede Corporation Uses Activity-Based Costing to Compute Product Margins ...

Bartow Corporation Uses an Activity Based Costing System to Assign ...