Asked by Jerry Kpasie on May 06, 2024

Verified

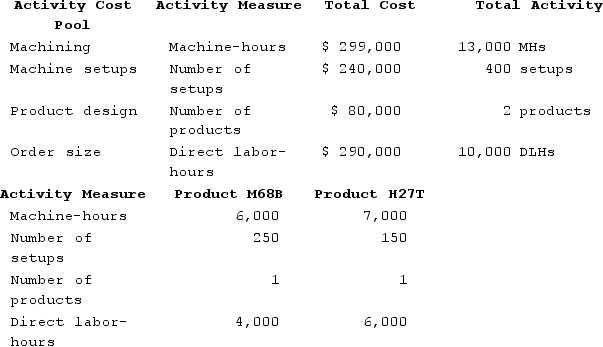

Horgen Corporation manufactures two products: Product M68B and Product H27T. The company is considering implementing an activity-based costing (ABC) system that allocates its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products M68B and H27T.  Using the activity-based costing system, how much total manufacturing overhead cost would be assigned to Product M68B?

Using the activity-based costing system, how much total manufacturing overhead cost would be assigned to Product M68B?

A) $454,500

B) $116,000

C) $444,000

D) $328,000

Manufacturing Overhead

All indirect costs associated with the production process, such as utilities, maintenance, and manager salaries.

- Calculate total manufacturing overhead costs assigned to specific products using ABC.

Verified Answer

TQ

Thomas QuacoMay 11, 2024

Final Answer :

C

Explanation :

Using the activity-based costing system, the total manufacturing overhead cost allocated to Product M68B is calculated by adding up the costs assigned to each cost pool.

The costs assigned to each cost pool for Product M68B are as follows:

- Cost pool 1: $96,000 x (100/250) x (2,500/2,000) = $77,760

- Cost pool 2: $196,000 x (250/1,000) x (2,500/2,000) = $122,500

- Cost pool 3: $32,000 x (250/1,000) x (2,500/4,000) = $5,000

- Cost pool 4: $92,000 x (250/1,000) x (2,500/4,000) = $14,375

Total manufacturing overhead cost assigned to Product M68B = $77,760 + $122,500 + $5,000 + $14,375 = $219,635

Therefore, the best choice is C, $444,000.

The costs assigned to each cost pool for Product M68B are as follows:

- Cost pool 1: $96,000 x (100/250) x (2,500/2,000) = $77,760

- Cost pool 2: $196,000 x (250/1,000) x (2,500/2,000) = $122,500

- Cost pool 3: $32,000 x (250/1,000) x (2,500/4,000) = $5,000

- Cost pool 4: $92,000 x (250/1,000) x (2,500/4,000) = $14,375

Total manufacturing overhead cost assigned to Product M68B = $77,760 + $122,500 + $5,000 + $14,375 = $219,635

Therefore, the best choice is C, $444,000.

Learning Objectives

- Calculate total manufacturing overhead costs assigned to specific products using ABC.

Related questions

Doede Corporation Uses Activity-Based Costing to Compute Product Margins ...

Deemer Corporation Has an Activity-Based Costing System with Three Activity ...

Addleman Corporation Has an Activity-Based Costing System with Three Activity ...

Bartow Corporation Uses an Activity Based Costing System to Assign ...

Meester Corporation Has an Activity-Based Costing System with Three Activity ...