Asked by Michelle Bradley on May 31, 2024

Verified

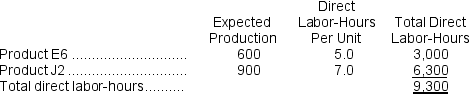

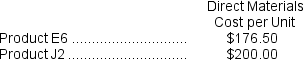

Weiskopf, Inc., manufactures and sells two products: Product E6 and Product J2.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $18.10 per DLH.The direct materials cost per unit for each product is given below:

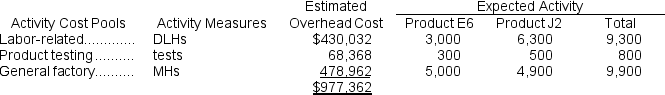

The direct labor rate is $18.10 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Which of the following statements concerning the unit product cost of Product J2 is true?

Which of the following statements concerning the unit product cost of Product J2 is true?

A) The unit product cost of Product J2 under traditional costing is less than its unit product cost under activity-based costing by $101.07.

B) The unit product cost of Product J2 under traditional costing is greater than its unit product under activity-based costing by $101.07.

C) The unit product cost of Product J2 under traditional costing is greater than its unit product under activity-based costing by $42.54.

D) The unit product cost of Product J2 under traditional costing is less than its unit product cost under activity-based costing by $42.54.

Product E6

A specific product or item in a company's lineup or inventory, indicated by the designation 'E6'.

Product J2

A specific item or model produced by a company, referred to as "J2."

Activity-Based Costing

An accounting method that assigns costs to products or services based on the activities they require, aiming to provide more accurate cost information.

- Assess and highlight the contrasts and comparisons between customary costing procedures and Activity-Based Costing in the context of pricing products.

- Assess the unit cost by employing both traditional and activity-based costing frameworks.

Verified Answer

RE

Rodolph El HajjJun 01, 2024

Final Answer :

B

Explanation :

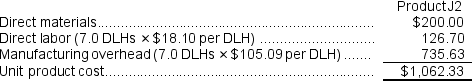

Predetermined overhead rate = Estimated total overhead ÷ Total direct labor-hours

= $977,362 ÷ 9,300 DLHs = $105.09 per DLH (rounded)

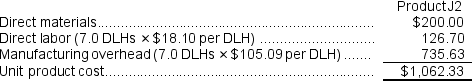

Computation of traditional unit product cost: Computation of activity rates:

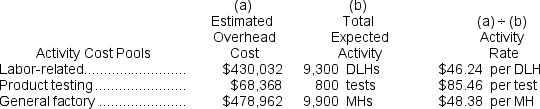

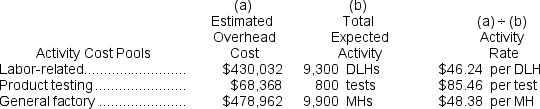

Computation of activity rates:  Computation of the overhead cost per unit under activity-based costing.

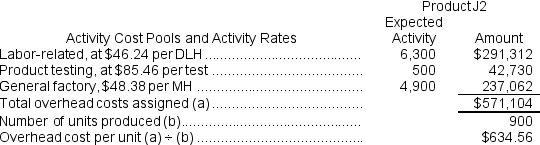

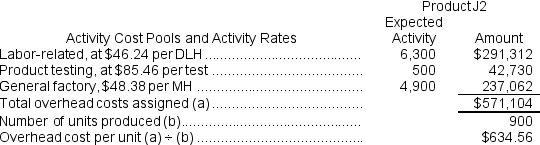

Computation of the overhead cost per unit under activity-based costing.  Computation of unit product cost under activity-based costing.

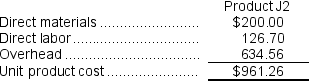

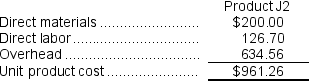

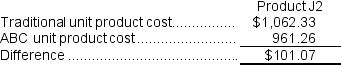

Computation of unit product cost under activity-based costing.  The difference in unit product costs is:

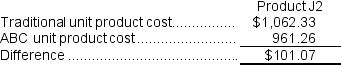

The difference in unit product costs is:  The unit product cost of Product J2 under traditional costing is greater than its unit product under activity-based costing by $101.07.

The unit product cost of Product J2 under traditional costing is greater than its unit product under activity-based costing by $101.07.

= $977,362 ÷ 9,300 DLHs = $105.09 per DLH (rounded)

Computation of traditional unit product cost:

Computation of activity rates:

Computation of activity rates:  Computation of the overhead cost per unit under activity-based costing.

Computation of the overhead cost per unit under activity-based costing.  Computation of unit product cost under activity-based costing.

Computation of unit product cost under activity-based costing.  The difference in unit product costs is:

The difference in unit product costs is:  The unit product cost of Product J2 under traditional costing is greater than its unit product under activity-based costing by $101.07.

The unit product cost of Product J2 under traditional costing is greater than its unit product under activity-based costing by $101.07.

Learning Objectives

- Assess and highlight the contrasts and comparisons between customary costing procedures and Activity-Based Costing in the context of pricing products.

- Assess the unit cost by employing both traditional and activity-based costing frameworks.