Asked by Taylor Casbon on Jun 19, 2024

Verified

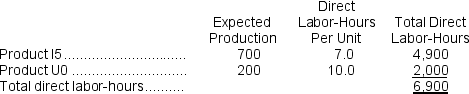

Seldomridge, Inc., manufactures and sells two products: Product I5 and Product U0.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $24.40 per DLH.The direct materials cost per unit for each product is given below:

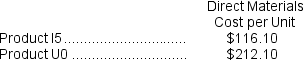

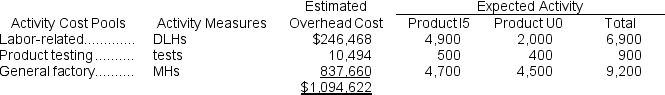

The direct labor rate is $24.40 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  The unit product cost of Product U0 under activity-based costing is closest to:

The unit product cost of Product U0 under activity-based costing is closest to:

A) $1,672.35 per unit

B) $2,504.73 per unit

C) $2,042.50 per unit

D) $2,885.25 per unit

Activity-Based Costing

A costing method that assigns overhead and indirect costs to related products and services based on the activities that generate the costs.

- Evaluate rates for overhead and apply these evaluations in determining the pricing of products according to Activity-Based Costing.

- Calculate unit product costs under both traditional and activity-based costing methods.

Verified Answer

KE

Kylah EssexJun 26, 2024

Final Answer :

D

Explanation :

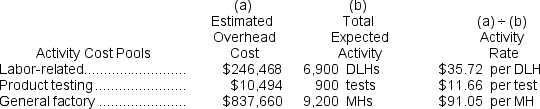

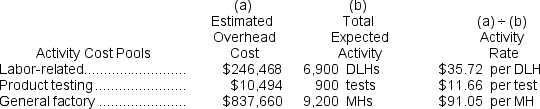

Computation of activity rates:  Computation of the overhead cost per unit under activity-based costing.

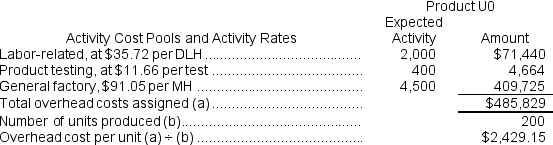

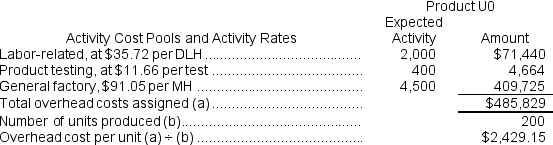

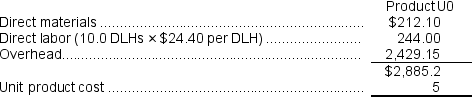

Computation of the overhead cost per unit under activity-based costing.  Computation of unit product costs under activity-based costing.

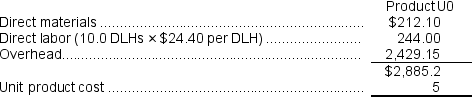

Computation of unit product costs under activity-based costing.

Computation of the overhead cost per unit under activity-based costing.

Computation of the overhead cost per unit under activity-based costing.  Computation of unit product costs under activity-based costing.

Computation of unit product costs under activity-based costing.

Learning Objectives

- Evaluate rates for overhead and apply these evaluations in determining the pricing of products according to Activity-Based Costing.

- Calculate unit product costs under both traditional and activity-based costing methods.