Asked by Andrea Alena on Jun 18, 2024

Verified

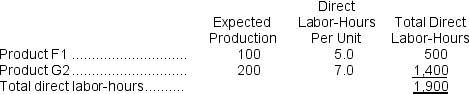

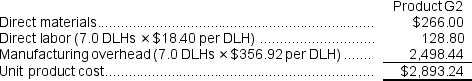

Manzano, Inc., manufactures and sells two products: Product F1 and Product G2.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $18.40 per DLH.The direct materials cost per unit is $248.70 for Product F1 and $266.00 for Product G2.The estimated total manufacturing overhead is $678,146. The unit product cost of Product G2 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:

The direct labor rate is $18.40 per DLH.The direct materials cost per unit is $248.70 for Product F1 and $266.00 for Product G2.The estimated total manufacturing overhead is $678,146. The unit product cost of Product G2 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:

A) $2,893.24 per unit

B) $751.24 per unit

C) $856.03 per unit

D) $674.24 per unit

Product F1

A specific product identified as F1, details of which would depend on the context in which it is referenced.

Direct Labor-Hours

The total hours worked by employees directly involved in manufacturing a product or providing a service.

- Analyze and differentiate between standard costing methods and Activity-Based Costing in the context of product pricing.

- Compute the price of each unit employing conventional and activity-based costing techniques.

Verified Answer

AF

Alexia FlowersJun 25, 2024

Final Answer :

A

Explanation :

Predetermined overhead rate = Estimated total overhead ÷ Total direct labor-hours

= $678,146 ÷ 1,900 DLHs = $356.92 per DLH (rounded)

Computation of traditional unit product cost:

= $678,146 ÷ 1,900 DLHs = $356.92 per DLH (rounded)

Computation of traditional unit product cost:

Learning Objectives

- Analyze and differentiate between standard costing methods and Activity-Based Costing in the context of product pricing.

- Compute the price of each unit employing conventional and activity-based costing techniques.