Asked by DeNae Schoel on May 01, 2024

Verified

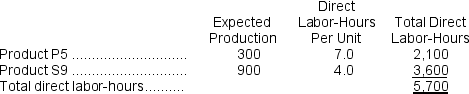

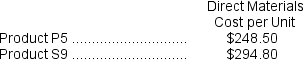

Howden, Inc., manufactures and sells two products: Product P5 and Product S9.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $25.70 per DLH.The direct materials cost per unit for each product is given below:

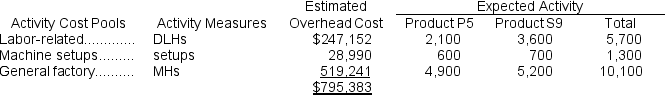

The direct labor rate is $25.70 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Which of the following statements concerning the unit product cost of Product S9 is true?

Which of the following statements concerning the unit product cost of Product S9 is true?

A) The unit product cost of Product S9 under traditional costing is less than its unit product cost under activity-based costing by $70.34.

B) The unit product cost of Product S9 under traditional costing is less than its unit product cost under activity-based costing by $700.00.

C) The unit product cost of Product S9 under traditional costing is greater than its unit product under activity-based costing by $70.34.

D) The unit product cost of Product S9 under traditional costing is greater than its unit product under activity-based costing by $700.00.

Activity-Based Costing

A costing method that assigns overhead and indirect costs to specific activities, providing detailed information on where and how costs are incurred.

- Evaluate the differences and parallels of traditional costing techniques versus Activity-Based Costing in product cost determination.

- Estimate the cost per unit with the application of traditional and activity-based costing systems.

Verified Answer

RE

Rodolph El HajjMay 03, 2024

Final Answer :

C

Explanation :

Under traditional costing, the unit product cost of Product S9 is calculated as follows:

Direct materials cost per unit + (Direct labor rate per DLH x DLHs per unit)

= $45.60 + ($25.70 x 1.2)

= $76.84

Under activity-based costing, the unit product cost of Product S9 is calculated as follows:

Cost per unit of activity 1 + (Cost per unit of activity 2 x activity 2 per unit) + (Cost per unit of activity 3 x activity 3 per unit)

= $50 + ($120 x 0.1) + ($300 x 0.2)

= $80

The unit product cost of Product S9 under traditional costing is greater than its unit product cost under activity-based costing by $70.34. Therefore, option C is correct.

Direct materials cost per unit + (Direct labor rate per DLH x DLHs per unit)

= $45.60 + ($25.70 x 1.2)

= $76.84

Under activity-based costing, the unit product cost of Product S9 is calculated as follows:

Cost per unit of activity 1 + (Cost per unit of activity 2 x activity 2 per unit) + (Cost per unit of activity 3 x activity 3 per unit)

= $50 + ($120 x 0.1) + ($300 x 0.2)

= $80

The unit product cost of Product S9 under traditional costing is greater than its unit product cost under activity-based costing by $70.34. Therefore, option C is correct.

Explanation :

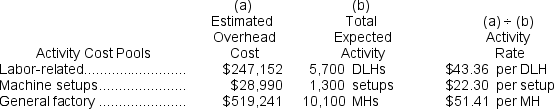

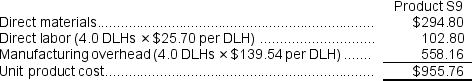

Predetermined overhead rate = Estimated total overhead ÷ Total direct labor-hours

= $795,383 ÷ 5,700 DLHs = $139.54 per DLH (rounded)

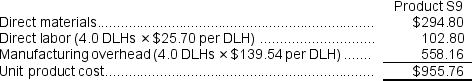

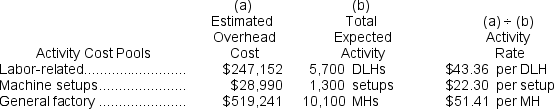

Computation of traditional unit product cost: Computation of activity rates:

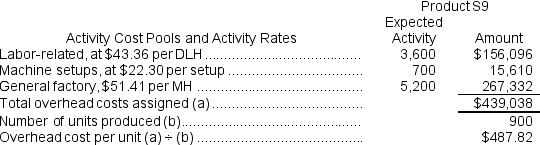

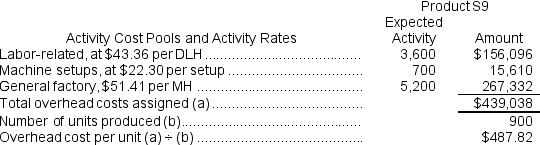

Computation of activity rates:  Computation of the overhead cost per unit under activity-based costing.

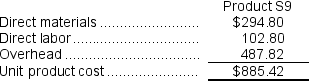

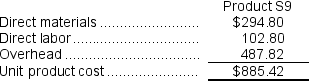

Computation of the overhead cost per unit under activity-based costing.  Computation of unit product cost under activity-based costing.

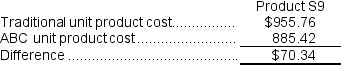

Computation of unit product cost under activity-based costing.  The difference in unit product costs is:

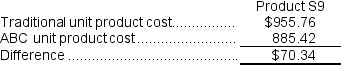

The difference in unit product costs is:  The unit product cost of Product S9 under traditional costing is greater than its unit product under activity-based costing by $70.34.

The unit product cost of Product S9 under traditional costing is greater than its unit product under activity-based costing by $70.34.

= $795,383 ÷ 5,700 DLHs = $139.54 per DLH (rounded)

Computation of traditional unit product cost:

Computation of activity rates:

Computation of activity rates:  Computation of the overhead cost per unit under activity-based costing.

Computation of the overhead cost per unit under activity-based costing.  Computation of unit product cost under activity-based costing.

Computation of unit product cost under activity-based costing.  The difference in unit product costs is:

The difference in unit product costs is:  The unit product cost of Product S9 under traditional costing is greater than its unit product under activity-based costing by $70.34.

The unit product cost of Product S9 under traditional costing is greater than its unit product under activity-based costing by $70.34.

Learning Objectives

- Evaluate the differences and parallels of traditional costing techniques versus Activity-Based Costing in product cost determination.

- Estimate the cost per unit with the application of traditional and activity-based costing systems.