Asked by Asive Sibeko on May 11, 2024

Verified

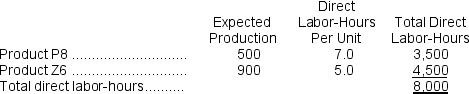

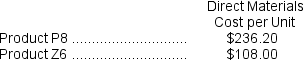

Busto, Inc., manufactures and sells two products: Product P8 and Product Z6.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $20.30 per DLH.The direct materials cost per unit for each product is given below:

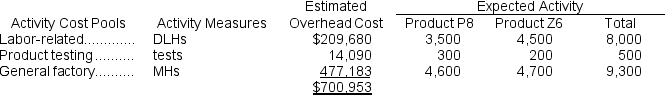

The direct labor rate is $20.30 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  The unit product cost of Product Z6 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:

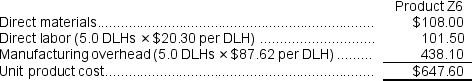

The unit product cost of Product Z6 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:

A) $340.55 per unit

B) $647.60 per unit

C) $466.05 per unit

D) $350.40 per unit

Activity-Based Costing

A method of costing that identifies activities in an organization and assigns the cost of each activity to all products and services according to the actual consumption.

- Compare and contrast traditional costing and ABC for product costing.

- Figure out the cost per individual unit via traditional and activity-based costing methods.

Verified Answer

PJ

Punnapat JirasarunpatMay 18, 2024

Final Answer :

B

Explanation :

Predetermined overhead rate = Estimated total overhead ÷ Total direct labor-hours

= $700,953 ÷ 8,000 DLHs = $87.62 per DLH (rounded)

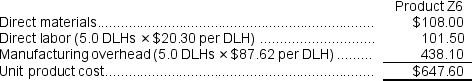

Computation of traditional unit product cost:

= $700,953 ÷ 8,000 DLHs = $87.62 per DLH (rounded)

Computation of traditional unit product cost:

Learning Objectives

- Compare and contrast traditional costing and ABC for product costing.

- Figure out the cost per individual unit via traditional and activity-based costing methods.