Asked by Teigan Catlin on Jun 22, 2024

Verified

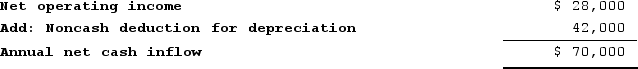

The management of Truelove Corporation is considering a project that would require an initial investment of $321,000 and would last for 7 years. The annual net operating income from the project would be $28,000, including depreciation of $42,000. At the end of the project, the scrap value of the project's assets would be $27,000. (Ignore income taxes.)Required:Determine the payback period of the project.

Payback Period

The length of time required to recover the cost of an investment or to reach the break-even point.

Initial Investment

The initial amount of money spent to start a project, purchase assets, or acquire a stake in a business venture.

Net Operating Income

A financial metric that calculates the profitability of a business's core operations, excluding the costs and returns of financial activities and one-time events.

- Acquire the ability to assess and figure out the payback duration for an investment.

- Predict future cash receipts and disbursements linked to investment initiatives.

Verified Answer

Payback period = Investment required ÷ Annual net cash inflow= $321,000 ÷ $70,000 = 4.59 years

Payback period = Investment required ÷ Annual net cash inflow= $321,000 ÷ $70,000 = 4.59 years

Learning Objectives

- Acquire the ability to assess and figure out the payback duration for an investment.

- Predict future cash receipts and disbursements linked to investment initiatives.

Related questions

Cardinal Pharmacy Has Purchased a Small Auto for Delivery of ...

Ursus, Incorporated, Is Considering a Project That Would Have a ...

The Payback Period Is the Length of Time It Takes ...

Buy-Rite Pharmacy Has Purchased a Small Auto for Delivering Prescriptions ...

Which Statement Below Is True About the Evaluation of an ...