Asked by Rauph Adeoba on May 20, 2024

Verified

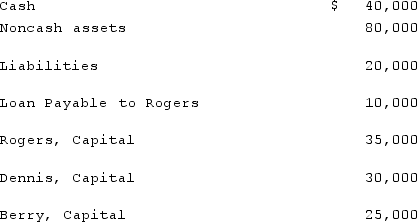

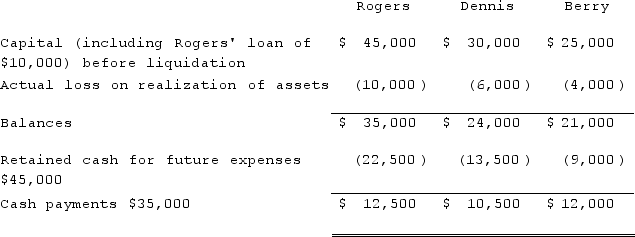

The balance sheet of Rogers, Dennis & Berry LLP prior to liquidation included the following:  The three partners shared net income and losses in a 5:3:2 ratio, respectively. Noncash assets were sold for $60,000. Creditors were paid in full, partners were paid $35,000, and the balance of cash was retained pending future developments.Determine the cash to be retained and prepare a schedule to distribute $35,000 cash to the partners.

The three partners shared net income and losses in a 5:3:2 ratio, respectively. Noncash assets were sold for $60,000. Creditors were paid in full, partners were paid $35,000, and the balance of cash was retained pending future developments.Determine the cash to be retained and prepare a schedule to distribute $35,000 cash to the partners.

Noncash Assets

Assets owned by a business or individual that are not in the form of cash or cash equivalents, such as buildings, machinery, or intellectual property.

Net Income and Losses

The total amount of money a company has earned (net income) or lost (net losses) during a specific period.

Liquidation

The process of ending a business and distributing its assets to claimants, typically occurring when a company becomes insolvent.

- Establish the method for allocating cash and other relevant assets during the closure of a partnership, focusing on the partners' capital accounts and the proportional sharing of profits and losses.

- Explore the consequences of disposing of noncash assets and clearing liabilities on the ultimate cash distribution within a partnership.

- Put into action the sharing ratios for profits and losses to determine the individual shares of profits, losses, and liquidation proceeds for partners.

Verified Answer

Learning Objectives

- Establish the method for allocating cash and other relevant assets during the closure of a partnership, focusing on the partners' capital accounts and the proportional sharing of profits and losses.

- Explore the consequences of disposing of noncash assets and clearing liabilities on the ultimate cash distribution within a partnership.

- Put into action the sharing ratios for profits and losses to determine the individual shares of profits, losses, and liquidation proceeds for partners.

Related questions

On January 1, 2021, the Partners of Won, Cadel, and ...

A Partnership Had the Following Account Balances: Cash, $91,000; Other ...

Hardin, Sutton, and Williams Have Operated a Local Business as ...

Used to Divide the Excess of Allowances Over Loss When ...

Jones and James' Partnership Capital Balances Are $65,000 and $85,000 ...