Asked by Franco Volschenk on Jun 27, 2024

Verified

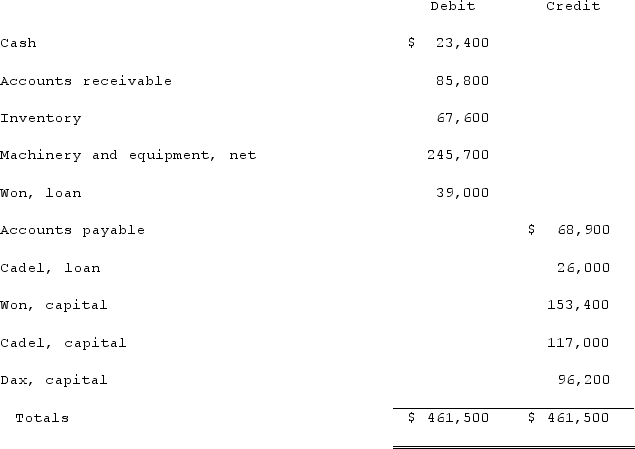

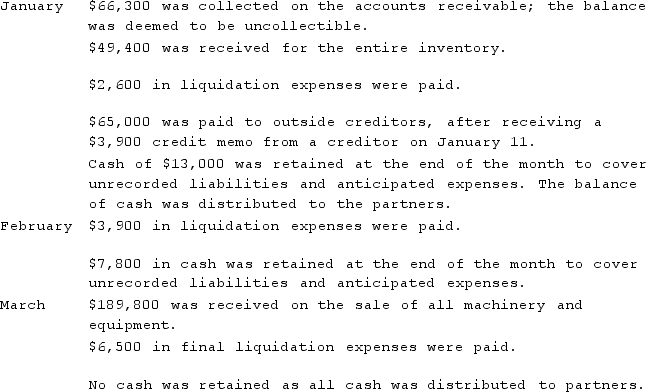

On January 1, 2021, the partners of Won, Cadel, and Dax (who shared profits and losses in the ratio of 5:3:2, respectively) decided to liquidate their partnership. The trial balance at this date was as follows:  The partners planned an installment program to dispose of the business assets and to minimize liquidation losses. All available cash, less an amount retained to provide for future expenses, was to be distributed to the partners at the end of each month. A summary of liquidation transactions follows:

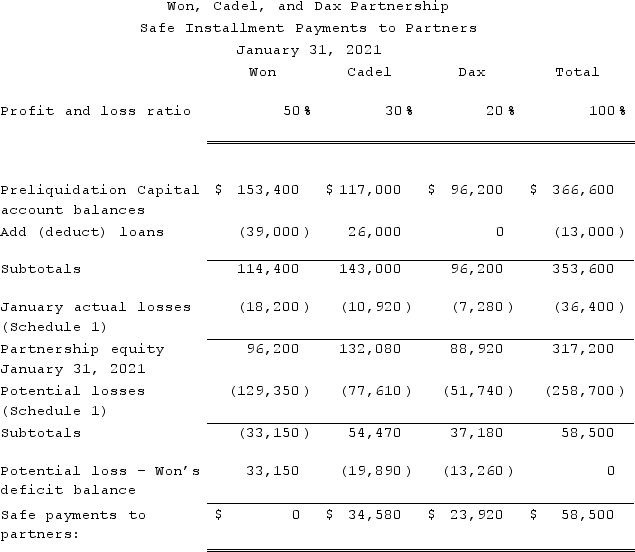

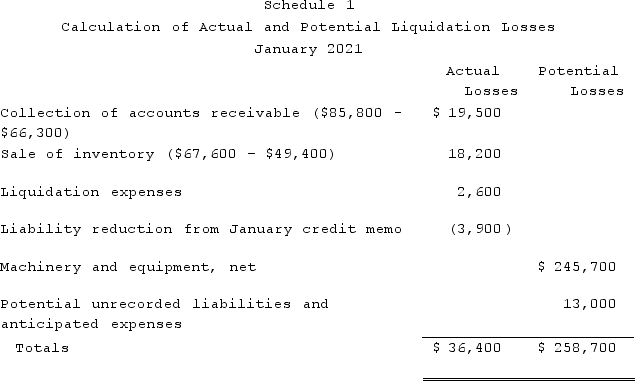

The partners planned an installment program to dispose of the business assets and to minimize liquidation losses. All available cash, less an amount retained to provide for future expenses, was to be distributed to the partners at the end of each month. A summary of liquidation transactions follows:  Prepare a schedule to calculate the safe payments to be made to the partners at the end of January.

Prepare a schedule to calculate the safe payments to be made to the partners at the end of January.

Installment Program

A payment plan allowing customers to purchase goods by making a series of payments over time until the total debt is paid.

Liquidation Transactions

Sales or disposals of assets by a company, typically occurring when the company is ceasing operations, to pay off creditors and distribute any remaining assets to shareholders.

Profit and Loss Ratio

A financial metric that compares the profits and losses of a business in a specific time period, often used to gauge operational performance.

- Ascertain the apportionment of cash and alternative assets upon partnership dissolution, with regard to partners' capital accounts and their respective profit and loss sharing ratios.

- Attain an understanding of the notion of secure payments and the process of their calculation in liquidation scenarios.

- Utilize the ratios for sharing profit and loss to ascertain the specific shares of profits, losses, and liquidation proceeds for each partner.

Verified Answer

Proof of cash: Beginning $23,400 + collect A/R $66,300 + collect on inventory $49,400 - paid liq. expenses $2,600 - paid A/P $65,000 - cash retained $13,000 = $58,500.

Proof of cash: Beginning $23,400 + collect A/R $66,300 + collect on inventory $49,400 - paid liq. expenses $2,600 - paid A/P $65,000 - cash retained $13,000 = $58,500.

Learning Objectives

- Ascertain the apportionment of cash and alternative assets upon partnership dissolution, with regard to partners' capital accounts and their respective profit and loss sharing ratios.

- Attain an understanding of the notion of secure payments and the process of their calculation in liquidation scenarios.

- Utilize the ratios for sharing profit and loss to ascertain the specific shares of profits, losses, and liquidation proceeds for each partner.

Related questions

The Balance Sheet of Rogers, Dennis & Berry LLP Prior ...

A Partnership Had the Following Account Balances: Cash, $91,000; Other ...

Used to Divide the Excess of Allowances Over Loss When ...

Partners Randy and Mary Each Have $3,000 Capital Balances and ...

Tom and Barb Are Partners Who Share Profits and Losses ...