Asked by Laura Bouchie on Apr 27, 2024

Verified

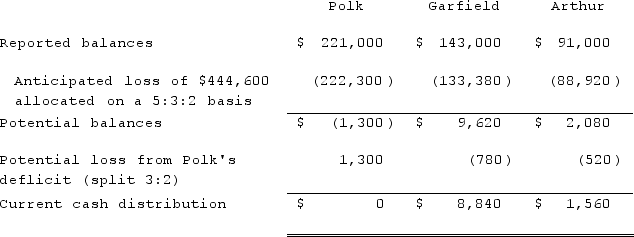

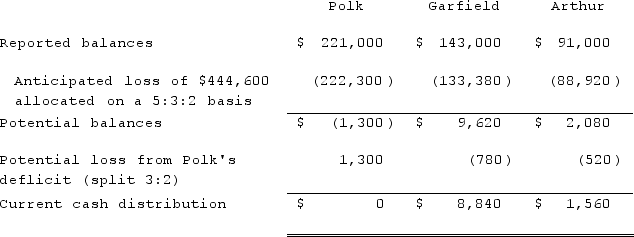

A partnership had the following account balances: Cash, $91,000; Other Assets, $702,000; Liabilities, $338,000; Polk, Capital (50% of profits and losses), $221,000; Garfield, Capital (30%), $143,000; Arthur, Capital (20%), $91,000. The company liquidated and $10,400 became available to the partners.Required:Who would have received the $10,400?

Liquidation

The process of bringing a business to an end and distributing its assets to claimants.

Account Balances

The amounts of money present in or owed on a company's accounts at any given time.

Capital

Capital refers to the financial resources or assets that are used to fund operations, invest in the business, or cover expenses.

- Formulate the disbursement plan of cash and other pertinent assets upon a partnership’s liquidation, taking into account the capital stakes of the partners and their profit and loss ratios.

- Execute the profit and loss sharing percentages to calculate the distinct allocations of profits, losses, and liquidation proceeds for each partner.

Verified Answer

TT

Tasfia TasnimMay 01, 2024

Final Answer :

Since the partnership had total capital of $455,000, the $10,400 that was available would have indicated maximum anticipated losses of $444,600.  The $10,400 would have gone to Garfield ($8,840) and Arthur ($1,560) .

The $10,400 would have gone to Garfield ($8,840) and Arthur ($1,560) .

The $10,400 would have gone to Garfield ($8,840) and Arthur ($1,560) .

The $10,400 would have gone to Garfield ($8,840) and Arthur ($1,560) .

Learning Objectives

- Formulate the disbursement plan of cash and other pertinent assets upon a partnership’s liquidation, taking into account the capital stakes of the partners and their profit and loss ratios.

- Execute the profit and loss sharing percentages to calculate the distinct allocations of profits, losses, and liquidation proceeds for each partner.

Related questions

The Balance Sheet of Rogers, Dennis & Berry LLP Prior ...

On January 1, 2021, the Partners of Won, Cadel, and ...

Used to Divide the Excess of Allowances Over Loss When ...

Partners Randy and Mary Each Have $3,000 Capital Balances and ...

Jones and James' Partnership Capital Balances Are $65,000 and $85,000 ...