Asked by Kwama Kenyatta on Jun 11, 2024

Verified

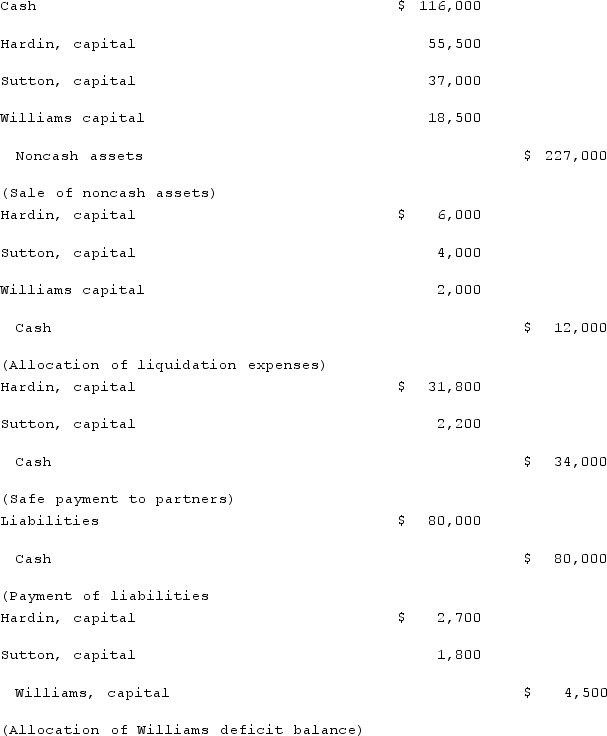

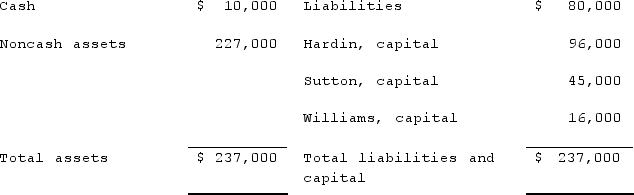

Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.The following balance sheet has been produced:  During the liquidation process, the following transactions take place:- Noncash assets are sold for $116,000.- Liquidation expenses of $12,000 are paid. No further expenses are expected.- Safe capital distributions are made to the partners.- Payment is made of all business liabilities.- Any deficit capital account balances are deemed to be uncollectible.Prepare journal entries to record the actual liquidation transactions.

During the liquidation process, the following transactions take place:- Noncash assets are sold for $116,000.- Liquidation expenses of $12,000 are paid. No further expenses are expected.- Safe capital distributions are made to the partners.- Payment is made of all business liabilities.- Any deficit capital account balances are deemed to be uncollectible.Prepare journal entries to record the actual liquidation transactions.

Liquidation Transactions

Transactions that occur when a company is in the process of closing and its assets are being sold off.

Capital Distributions

Capital distributions are payments made by a corporation to its shareholders from its capital base, as opposed to payments made from earnings or profit.

Liquidation Expenses

Costs associated with disbanding a company or partnership, including selling off assets, paying off creditors, and distributing any remaining assets to shareholders or partners.

- Comprehend the procedure for dissolving a partnership and the determinants affecting the allocation of proceeds from the liquidation.

- Acquire knowledge on the treatment of partners' negative balances throughout the liquidation process, emphasizing the partners' duty to make up for these deficiencies.

- Examine the impacts of liquidating noncash assets and resolving liabilities on the final cash distribution of the partnership.

Verified Answer

MC

Learning Objectives

- Comprehend the procedure for dissolving a partnership and the determinants affecting the allocation of proceeds from the liquidation.

- Acquire knowledge on the treatment of partners' negative balances throughout the liquidation process, emphasizing the partners' duty to make up for these deficiencies.

- Examine the impacts of liquidating noncash assets and resolving liabilities on the final cash distribution of the partnership.