Asked by Priyani Patel on Jul 24, 2024

Verified

Jones and James' partnership capital balances are $65,000 and $85,000, respectively. They share profits and losses in a 1:3 ratio for Jones and James, respectively. Johnson is admitted to the partnership and invests $55,000 for a one-fourth interest, with a bonus to the old partners. Prepare the journal entry to admit Johnson to the partnership.

Capital Balances

The amount of money that partners or owners have invested in the business.

Profits and Losses

Financial results of a company's operations, with profits indicating net income and losses indicating net expenses exceeding revenues.

Admitted

The term is commonly used in insurance, indicating an insurer is licensed to operate in a particular state. Otherwise, NO.

- Comprehend the economic consequences of integrating new partners into a partnership, focusing on capital investments and the assessment of incoming assets and obligations.

- Comprehend the principle of bonus disbursements in associations and their effect on capital balances and partner equity.

- Recognize and compute the allocation of gains and deficits among associates based on various contracts and proportions.

Verified Answer

JW

Jasmine WilliamsJul 29, 2024

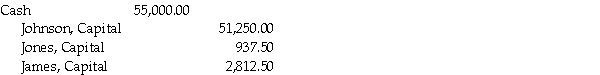

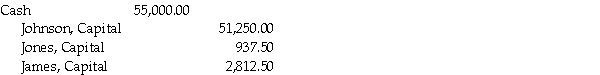

Final Answer :  Total capital = $68,000 + $85,000 + $55,000 = $205,000

Total capital = $68,000 + $85,000 + $55,000 = $205,000

1/4 × $205,000 = $51,250

$55,000 - $51,250 = $3,750 bonus to old partners

Jones = 1/4 × $3,750 = $937.50

James = 3/4 × $3,750 = $2,812.50

Total capital = $68,000 + $85,000 + $55,000 = $205,000

Total capital = $68,000 + $85,000 + $55,000 = $205,0001/4 × $205,000 = $51,250

$55,000 - $51,250 = $3,750 bonus to old partners

Jones = 1/4 × $3,750 = $937.50

James = 3/4 × $3,750 = $2,812.50

Learning Objectives

- Comprehend the economic consequences of integrating new partners into a partnership, focusing on capital investments and the assessment of incoming assets and obligations.

- Comprehend the principle of bonus disbursements in associations and their effect on capital balances and partner equity.

- Recognize and compute the allocation of gains and deficits among associates based on various contracts and proportions.