Asked by Wenlu Zhang on Apr 24, 2024

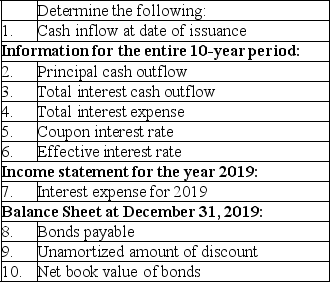

Steamboat Company issued the following ten-year bonds on January 1,2019: $100,000 maturity value,6% interest payable annually on each December 31.The bonds were dated January 1,2019 and the accounting period ends December 31.The bonds were issued for $93,000.Steamboat uses the effective-interest method for amortization.The amortization for 2019 was $510.

A.

B.Assuming instead that the accounting period ends on June 30,prepare the adjusting entry related to interest expense and the interest accrual at June 30.No adjusting entries have been made during the year.

B.Assuming instead that the accounting period ends on June 30,prepare the adjusting entry related to interest expense and the interest accrual at June 30.No adjusting entries have been made during the year.

Effective-Interest Method

An accounting practice used to amortize the discount or premium on bonds payable over the bond’s life, reflecting a constant rate of interest.

Bonds

Long-term debt securities issued by corporations or governments, promising to pay the holder a specified amount of interest over a set period of time before returning the principal amount.

Amortization

The process of gradually writing off the initial cost of an intangible asset over a period of time, reflecting its consumption, expiration, or obsolescence.

- Generate bookkeeping entries for the issuance of bonds, interest payments, and amortization following the effective interest method.

Learning Objectives

- Generate bookkeeping entries for the issuance of bonds, interest payments, and amortization following the effective interest method.

Related questions

On January 1,2019,Laramie Company Issued $500,000,4%,five-Year Bonds Payable at 92 ...

On January 1,2019,Mendez Company Issued 400 of Its $1,000,ten-Year,9% Bonds ...

A Company Issued 10-Year,9% Bonds with a Par Value of ...

On April 1,a Company Issues 6%,10-Year,$600,000 Par Value Bonds That ...

On January 1,a Company Issued 10-Year,10% Bonds Payable with a ...