Asked by Chasity Kleinsorge on Jul 05, 2024

Verified

On January 1,2019,Mendez Company issued 400 of its $1,000,ten-year,9% bonds.The bonds were dated January 1,2019,and interest is paid annually each December 31.The bonds were issued at 99.

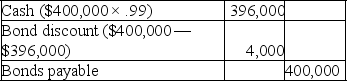

Part A: Prepare the entry to record the issuance of the bonds on January 1,2019:

Part B: Were the bonds issued at par,at a premium,or at a discount? How did you arrive at your answer?

Issued

Refers to the process whereby a company distributes shares to shareholders, which can include both the initial offering to the public and subsequent offerings.

Premium

An additional amount paid over the normal cost, often associated with insurance or bonds.

Discount

In finance, this is the reduction from the face value of a note, bond, or other financial instrument; in commerce, it refers to a reduction from the regular price.

- Acquire insight into how the pricing of bonds, coupon yields, and current market interest rates are interconnected.

- Set down in the journal the activities involving the issuance of bonds, paying out interests, and amortization adhering to the effective interest method.

Verified Answer

Part B:

Part B:The bonds were issued at discount.They were issued at 99,which means the bond price equals 99% of the face or par value.Since 99 is less than 100%,the bonds were issued at less than par,which is at a discount.

Learning Objectives

- Acquire insight into how the pricing of bonds, coupon yields, and current market interest rates are interconnected.

- Set down in the journal the activities involving the issuance of bonds, paying out interests, and amortization adhering to the effective interest method.

Related questions

If a Bond Is Issued at 101,the Coupon Rate Was ...

On January 1,2019,Laramie Company Issued $500,000,4%,five-Year Bonds Payable at 92 ...

Steamboat Company Issued the Following Ten-Year Bonds on January 1,2019 ...

Any Regular Coupon Bond of Any Maturity Will Sell for ...

For Two Bonds Identical but for Coupon, the Market Price ...