Asked by Vikki Yager on Jun 10, 2024

Verified

A company issued 10-year,9% bonds with a par value of $500,000 when the market rate was 9.5%.The company received $484,087 in cash proceeds.Using the straight-line method,prepare the issuer's journal entry to record the first semiannual interest payment and the amortization of any bond discount or premium.(Round amounts to the nearest whole dollar)

Semiannual Interest

Interest that is computed and disbursed semi-annually, commonly associated with bonds and loans.

Straight-Line Method

A method of calculating depreciation or amortization by evenly distributing the cost over the useful life of the asset.

Amortization

The process of gradually writing off the initial cost of an intangible asset over a period of time.

- Prepare journal entries for bond interest payments using different amortization methods.

Verified Answer

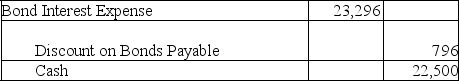

Cash payment: $500,000 * 9% * 1/2 year = $22,500

Cash payment: $500,000 * 9% * 1/2 year = $22,500Discount amortized: ($500,000 - $484,087)/20 semiannual periods = $795.65

Interest expense: $22,500 + $795.65 = $23,295.65

Learning Objectives

- Prepare journal entries for bond interest payments using different amortization methods.

Related questions

On January 1,a Company Issued 10-Year,10% Bonds Payable with a ...

On April 1,a Company Issues 6%,10-Year,$600,000 Par Value Bonds That ...

Steamboat Company Issued the Following Ten-Year Bonds on January 1,2019 ...

On January 1,2019,Laramie Company Issued $500,000,4%,five-Year Bonds Payable at 92 ...

On January 1,2019,Mendez Company Issued 400 of Its $1,000,ten-Year,9% Bonds ...