Asked by Louie Allard on Jul 09, 2024

Verified

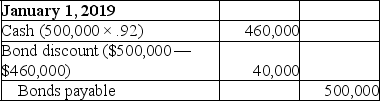

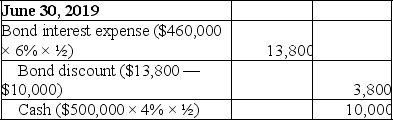

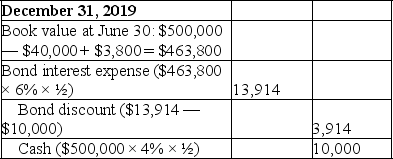

On January 1,2019,Laramie Company issued $500,000,4%,five-year bonds payable at 92.The market rate at the date of issue is 6%.Interest is payable semiannually at each June 30 and December 31.Laramie has a December 31 year-end and uses the effective interest method of amortization.

A.Prepare the journal entry to record the issuance of the bonds on January 1,2019.

B.Prepare the journal entry to record the first interest payment and interest expense at June 30,2019.No entries have yet been made for interest on these bonds.

C.Prepare the journal entry to record the second interest payment and interest expense at December 31,2019.No entries have been made for these bonds since June 30,2019.

D.What would the carrying value of the bonds be on December 31,2019?

Effective Interest Method

A technique used for calculating the interest income of a debt investment over its expected life, adjusting for the impact of amortizing any discount or premium on the purchase price of the bond.

Journal Entry

A record of the financial transactions of a business, documented in the general ledger accounts.

Issuance

Issuance refers to the process of making securities available for sale by a corporation or government entity, typically in the context of raising capital.

- Determine the book value of a bond liability through the use of the effective interest method for amortization.

- Derive journal entries for the launch of bonds, interest payouts, and amortization using the effective interest practice.

Verified Answer

B.

B. C.

C. D.Carrying value = $500,000 - ($40,000 - $3,800 - $3,914)= $467,714.

D.Carrying value = $500,000 - ($40,000 - $3,800 - $3,914)= $467,714.Alternatively: Carrying value = $460,000 + $3,800 + $3,914 = $467,714.

Learning Objectives

- Determine the book value of a bond liability through the use of the effective interest method for amortization.

- Derive journal entries for the launch of bonds, interest payouts, and amortization using the effective interest practice.

Related questions

On January 1,2019,Mendez Company Issued 400 of Its $1,000,ten-Year,9% Bonds ...

Steamboat Company Issued the Following Ten-Year Bonds on January 1,2019 ...

A Company Issued 10-Year,9% Bonds with a Par Value of ...

On January 1,a Company Issued 10-Year,10% Bonds Payable with a ...

On April 1,a Company Issues 6%,10-Year,$600,000 Par Value Bonds That ...