Asked by Teresa Salina on May 22, 2024

Verified

On April 1,a company issues 6%,10-year,$600,000 par value bonds that pay interest semiannually each March 31 and September 30.The bonds sold at $592,000.The company uses the straight-line method of amortizing bond discounts.Prepare the general journal entry to record the first interest payment on September 30.

Straight-Line Method

A depreciation technique that allocates an equal amount of depreciation expense for an asset over its useful life.

General Journal Entry

A record in the general journal that includes all the financial transactions of a company, showing accounts affected, amounts, and whether those amounts are debits or credits.

Amortizing

The process of gradually paying off a debt over time through regular payments.

- Master the technique of journalizing bond interest payment entries employing diverse amortization strategies.

Verified Answer

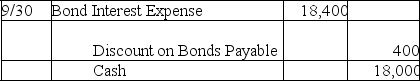

Cash Payment = $600,000 * 6% * 6/12 = $18,000

Cash Payment = $600,000 * 6% * 6/12 = $18,000Discount on Bonds Payable = ($600,000 - $592,000)/20 = $400

Interest expense = $18,000 + $400 = $18,400

Learning Objectives

- Master the technique of journalizing bond interest payment entries employing diverse amortization strategies.

Related questions

On January 1,a Company Issued 10-Year,10% Bonds Payable with a ...

A Company Issued 10-Year,9% Bonds with a Par Value of ...

Steamboat Company Issued the Following Ten-Year Bonds on January 1,2019 ...

On January 1,2019,Laramie Company Issued $500,000,4%,five-Year Bonds Payable at 92 ...

On January 1,2019,Mendez Company Issued 400 of Its $1,000,ten-Year,9% Bonds ...