Asked by Matthew Valenzuela on Jun 18, 2024

Verified

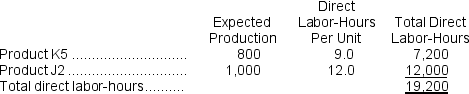

Skiver, Inc., manufactures and sells two products: Product K5 and Product J2.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

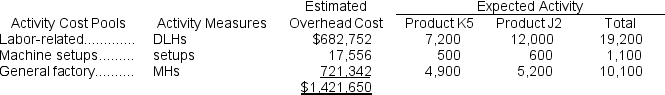

The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  The total overhead applied to Product K5 under activity-based costing is closest to:

The total overhead applied to Product K5 under activity-based costing is closest to:

A) $613,970

B) $533,088

C) $349,960

D) $631,848

Activity-Based Costing

An accounting method that assigns costs to products or services based on the activities performed in their production, offering more precise product costing.

- Achieve proficiency in the principles and application of activity-based costing (ABC).

- Compute the overhead percentages and employ these computations to establish product costs in the framework of Activity-Based Costing.

Verified Answer

LD

LAUREN DAVISJun 24, 2024

Final Answer :

A

Explanation :

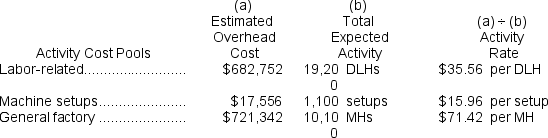

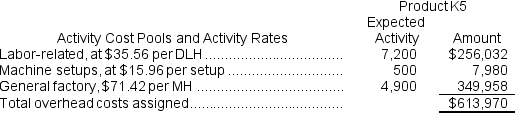

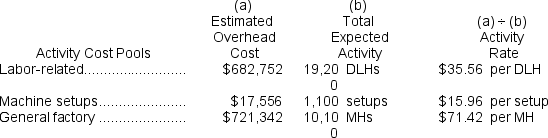

Computation of activity rates:  Computation of the overhead cost under activity-based costing.

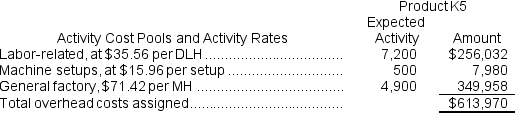

Computation of the overhead cost under activity-based costing.

Computation of the overhead cost under activity-based costing.

Computation of the overhead cost under activity-based costing.

Learning Objectives

- Achieve proficiency in the principles and application of activity-based costing (ABC).

- Compute the overhead percentages and employ these computations to establish product costs in the framework of Activity-Based Costing.