Asked by Dominique Harris on Jun 23, 2024

Verified

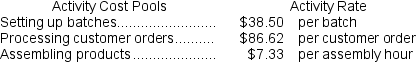

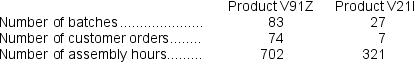

Senff Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products:  Data concerning two products appear below:

Data concerning two products appear below:  How much overhead cost would be assigned to Product V91Z using the activity-based costing system?

How much overhead cost would be assigned to Product V91Z using the activity-based costing system?

A) $113,774.55

B) $132.45

C) $3,195.50

D) $14,751.04

Activity Rates

Rates used in activity-based costing to assign costs to products or services based on the amount of an activity they consume.

Activity-Based Costing

A method of costing that identifies individual activities as the fundamental cost objects and uses the costs of these activities to compute the costs of various products or services.

- Derive overhead rates and use them to figure out the costs of products following an Activity-Based Costing approach.

- Absorb the principles of allocating overhead expenses across various activity drivers.

Verified Answer

DM

Desak Made Prathivi WulandariJun 25, 2024

Final Answer :

D

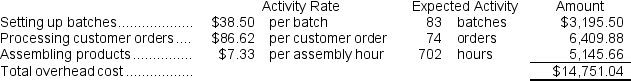

Explanation :

The overhead cost charged to Product V91Z is:

Learning Objectives

- Derive overhead rates and use them to figure out the costs of products following an Activity-Based Costing approach.

- Absorb the principles of allocating overhead expenses across various activity drivers.