Asked by ahmad sirri on Jun 19, 2024

Verified

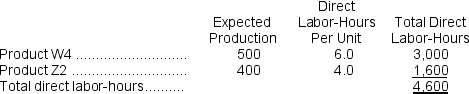

Lazano, Inc., manufactures and sells two products: Product W4 and Product Z2.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

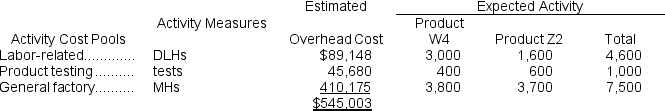

The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  The overhead applied to each unit of Product Z2 under activity-based costing is closest to:

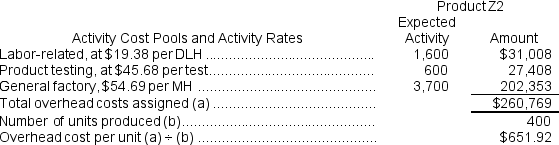

The overhead applied to each unit of Product Z2 under activity-based costing is closest to:

A) $473.92 per unit

B) $651.92 per unit

C) $605.56 per unit

D) $505.88 per unit

Activity-Based Costing

Activity-based costing is an accounting method that identifies and assigns costs to specific activities, facilitating more precise economic analysis of various business processes.

- Absorb the key elements and practical use of activity-based costing (ABC).

- Estimate overhead rates and make use of these estimates to calculate the costs of products employing Activity-Based Costing principles.

Verified Answer

JK

Jaquist KelleyJun 25, 2024

Final Answer :

B

Explanation :

First, we need to calculate the predetermined overhead rate for each activity cost pool by dividing the total overhead cost for each pool by its expected activity:

Activity 1: $18,000 / 2,000 DLHs = $9 per DLH

Activity 2: $45,000 / 10 setups = $4,500 per setup

Activity 3: $36,000 / 6 design changes = $6,000 per design change

Activity 4: $27,000 / 900 machine-hours = $30 per machine-hour

Then, we need to allocate the overhead costs to each product based on their use of the activity measures:

Product W4:

Activity 1: 1,000 DLHs x $9 per DLH = $9,000

Activity 2: 3 setups x $4,500 per setup = $13,500

Activity 3: 2 design changes x $6,000 per design change = $12,000

Activity 4: 500 machine-hours x $30 per machine-hour = $15,000

Total overhead cost = $49,500

Overhead cost per unit = $49,500 / 2,000 units = $24.75 per unit

Product Z2:

Activity 1: 1,000 DLHs x $9 per DLH = $9,000

Activity 2: 7 setups x $4,500 per setup = $31,500

Activity 3: 4 design changes x $6,000 per design change = $24,000

Activity 4: 300 machine-hours x $30 per machine-hour = $9,000

Total overhead cost = $73,500

Overhead cost per unit = $73,500 / 600 units = $122.50 per unit

However, we are asked to find the overhead applied per DLH for each product. Therefore, we need to divide the overhead cost per unit by the total DLHs required to produce each unit:

Product W4: $24.75 per unit / 2 DLHs per unit = $12.375 per DLH

Product Z2: $122.50 per unit / 5 DLHs per unit = $24.50 per DLH

Therefore, the overhead applied to each unit of Product Z2 under activity-based costing is closest to $24.50 per DLH or $651.92 per unit. The answer is B.

Activity 1: $18,000 / 2,000 DLHs = $9 per DLH

Activity 2: $45,000 / 10 setups = $4,500 per setup

Activity 3: $36,000 / 6 design changes = $6,000 per design change

Activity 4: $27,000 / 900 machine-hours = $30 per machine-hour

Then, we need to allocate the overhead costs to each product based on their use of the activity measures:

Product W4:

Activity 1: 1,000 DLHs x $9 per DLH = $9,000

Activity 2: 3 setups x $4,500 per setup = $13,500

Activity 3: 2 design changes x $6,000 per design change = $12,000

Activity 4: 500 machine-hours x $30 per machine-hour = $15,000

Total overhead cost = $49,500

Overhead cost per unit = $49,500 / 2,000 units = $24.75 per unit

Product Z2:

Activity 1: 1,000 DLHs x $9 per DLH = $9,000

Activity 2: 7 setups x $4,500 per setup = $31,500

Activity 3: 4 design changes x $6,000 per design change = $24,000

Activity 4: 300 machine-hours x $30 per machine-hour = $9,000

Total overhead cost = $73,500

Overhead cost per unit = $73,500 / 600 units = $122.50 per unit

However, we are asked to find the overhead applied per DLH for each product. Therefore, we need to divide the overhead cost per unit by the total DLHs required to produce each unit:

Product W4: $24.75 per unit / 2 DLHs per unit = $12.375 per DLH

Product Z2: $122.50 per unit / 5 DLHs per unit = $24.50 per DLH

Therefore, the overhead applied to each unit of Product Z2 under activity-based costing is closest to $24.50 per DLH or $651.92 per unit. The answer is B.

Explanation :

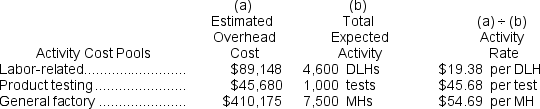

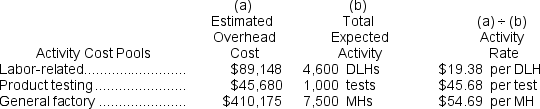

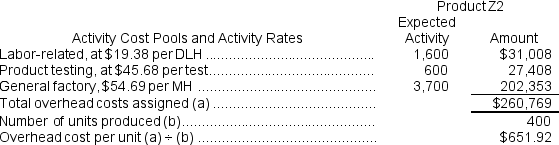

Computation of activity rates:  Computation of the overhead cost per unit under activity-based costing.

Computation of the overhead cost per unit under activity-based costing.

Computation of the overhead cost per unit under activity-based costing.

Computation of the overhead cost per unit under activity-based costing.

Learning Objectives

- Absorb the key elements and practical use of activity-based costing (ABC).

- Estimate overhead rates and make use of these estimates to calculate the costs of products employing Activity-Based Costing principles.